Budget & Tax

Curtis Shelton | September 10, 2018

A look at August 2018 gross receipts

Curtis Shelton

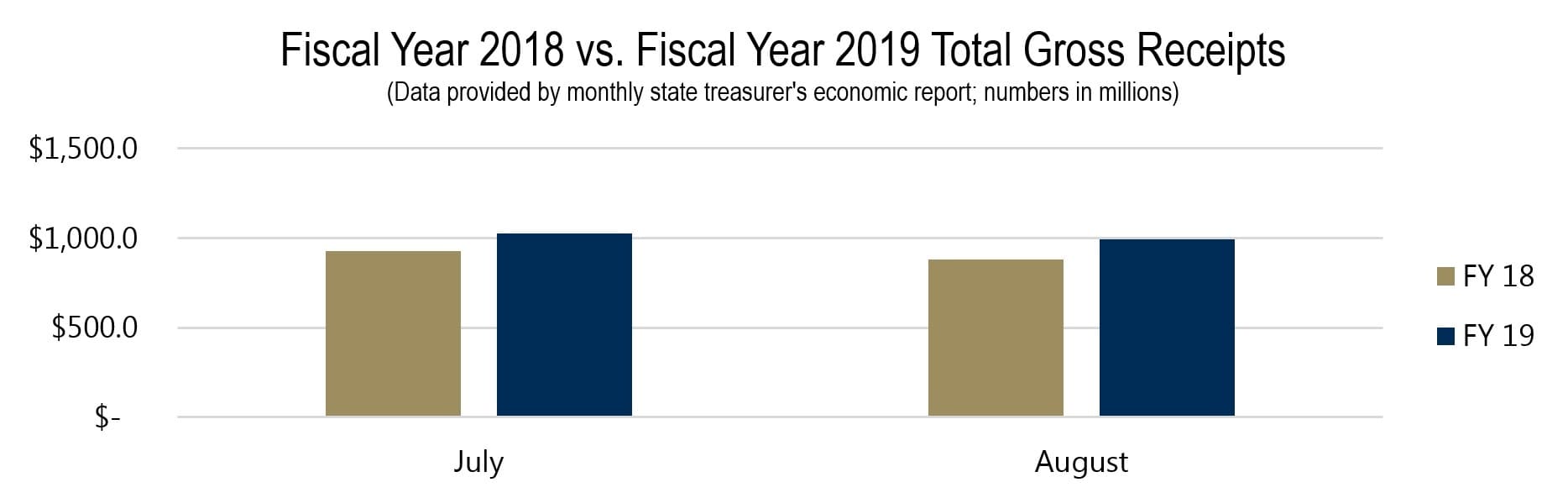

The Oklahoma Treasurer released the monthly report for August’s revenue collections. The report shows Total Gross Receipts collected in August were $995.1 million—a 13.1%, or $115.4 million, increase for the same month from the prior year.

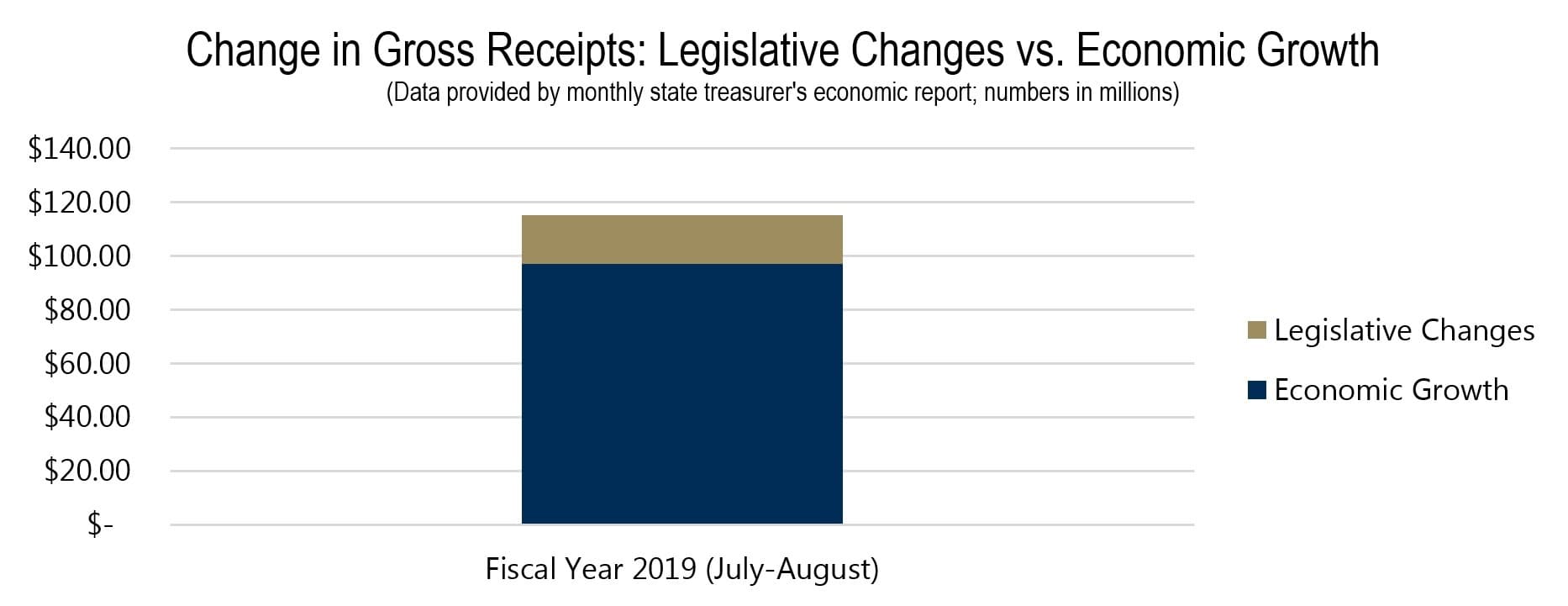

Revenue from legislative changes made during the 2018 session took effect for the first time this month. These changes amounted to $18.3 million, or 16%, of the total growth for the month. The $1 increase in a pack of cigarettes brought in the largest amount of new revenue at $8.3 million, while the six-cent increase in the diesel fuel tax brought in the smallest amount at $4.9 million.

Of the four major tax sources, the gross production tax saw the largest percentage increase year-to-year at 64.3%. Oklahoma Treasurer Ken Miller noted this increase is not attributable to the increase from 3% to 5% in the gross production tax as it has yet to generate additional revenue. The motor vehicle tax saw the smallest increase at 1.3%.

Curtis Shelton

Policy Research Fellow

Curtis Shelton currently serves as a policy research fellow for OCPA with a focus on fiscal policy. Curtis graduated Oklahoma State University in 2016 with a Bachelors of Arts in Finance. Previously, he served as a summer intern at OCPA and spent time as a staff accountant for Sutherland Global Services.