Budget & Tax

Curtis Shelton | May 11, 2018

A look at tax collections

Curtis Shelton

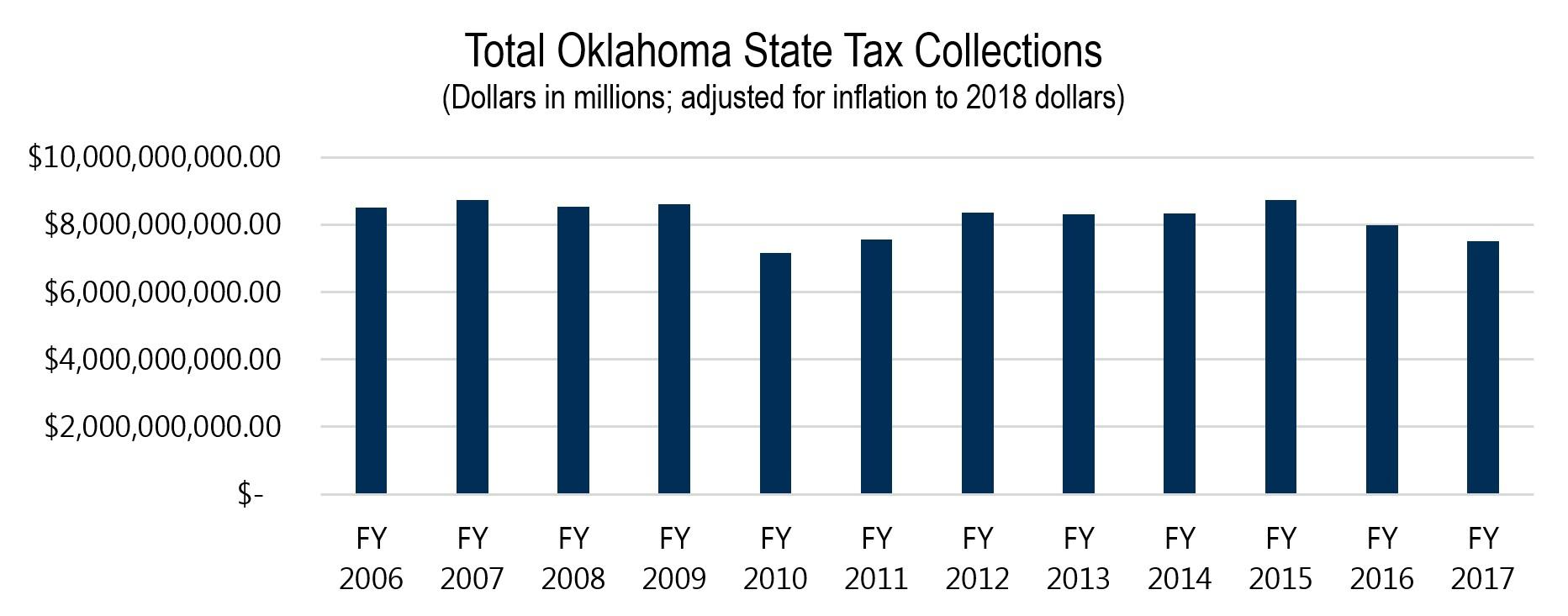

Total state tax collections are rebounding from a low point in fiscal year 2017 (July 2016 through June 2017). The slump was the result of the state struggling through the recession caused by the drop in oil prices in 2014 and 2015. Tax collections in the current fiscal year have come in not just above the previous year, but also higher than predicted.

The two largest sources of state tax collections are the individual income tax and the sales tax. These two taxes are a good barometer of how the state economy is performing. Following the national recession in 2009 and the state recession in 2015, these revenue sources correspondingly fell. The chart below shows the correlation between the economy and tax collections: dips in collections reflect the recent recessions during the past decade. This recent downturn came off a near-record level in tax collections in fiscal year 2015. (The last few months of calendar year 2017 saw an improved economy; those collections are not included because Oklahoma’s state fiscal years end in June.)

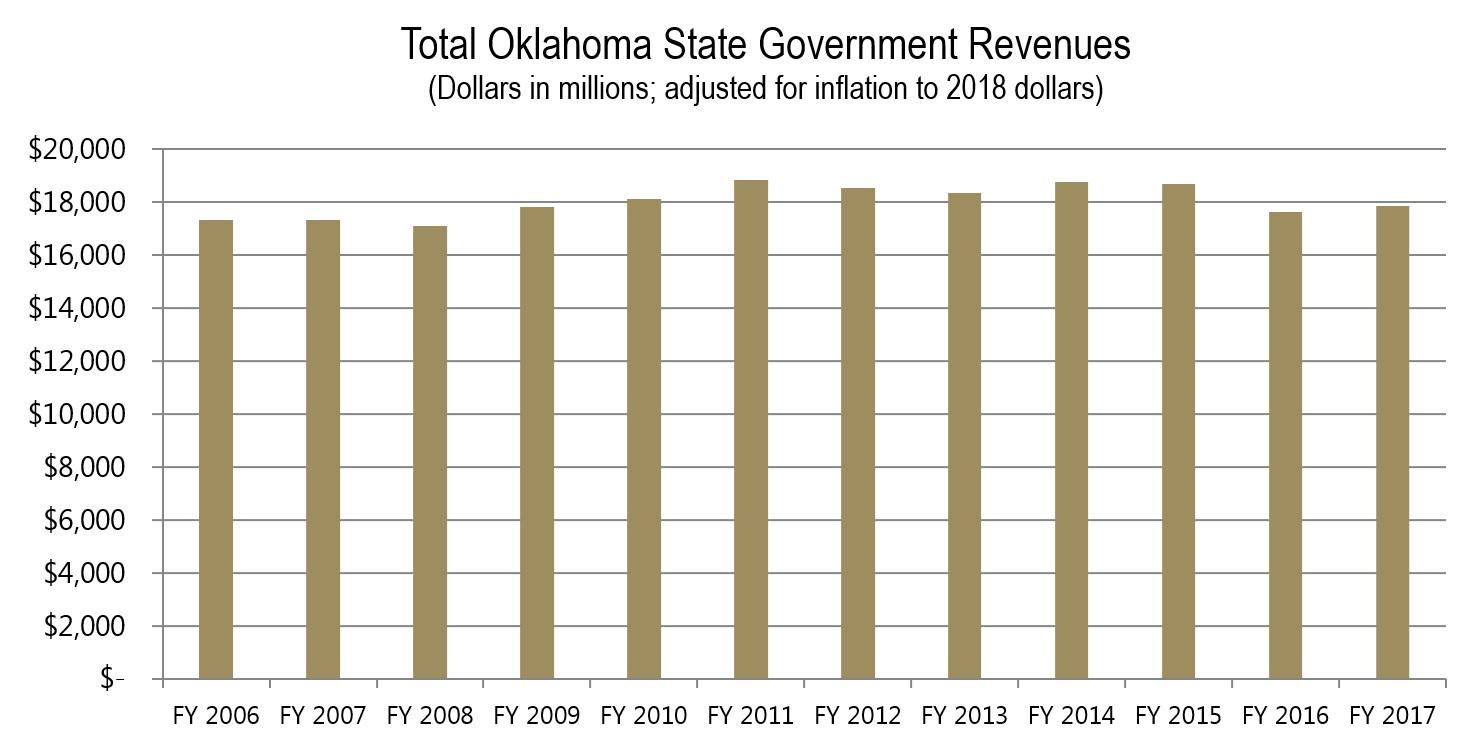

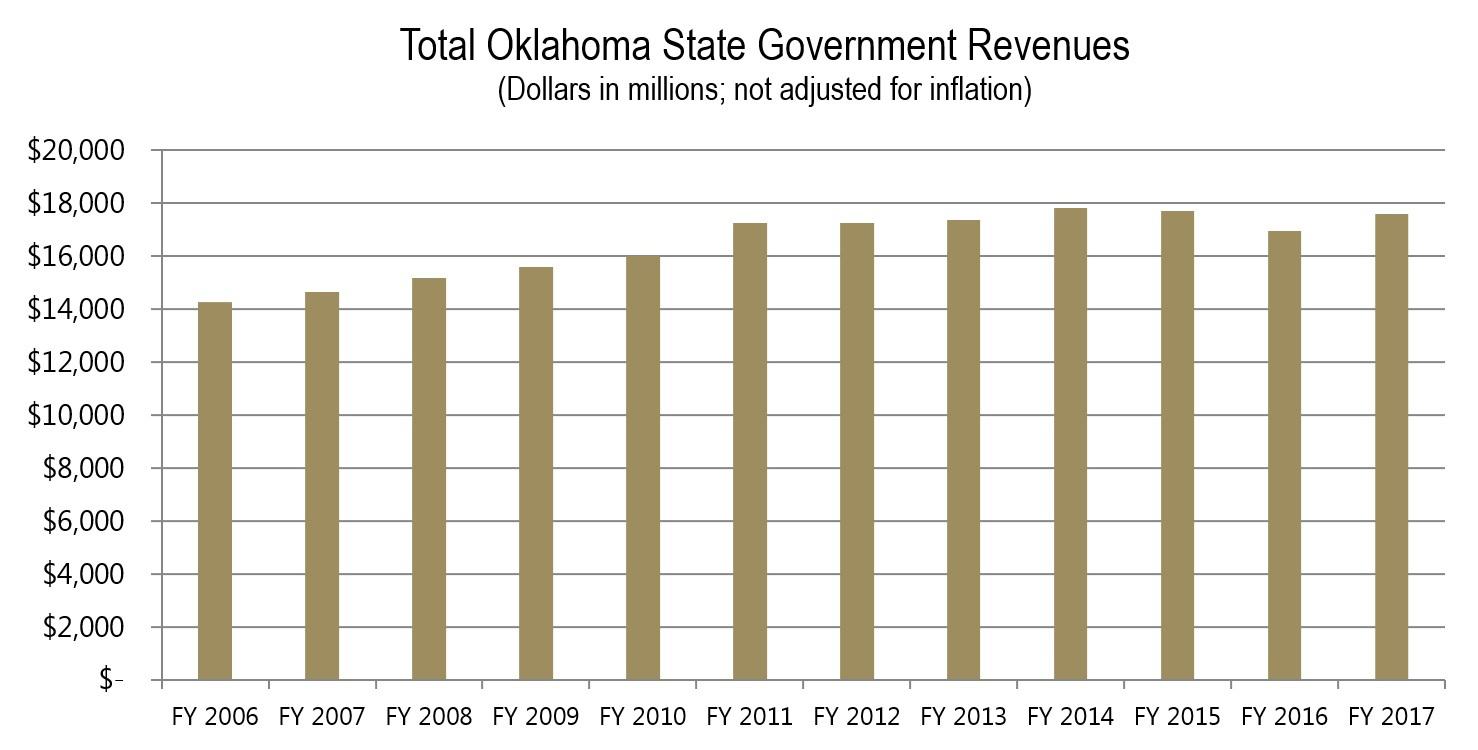

Despite the lower revenue from tax collections, total state revenues grew from fiscal year 2016 to fiscal year 2017. While tax collections make up around half of state revenues, other revenues fluctuate and can offset declines in taxes. Even as tax collections fell by $474 million (adjusted for inflation), total state revenues rose by $221 million in fiscal year 2017 from the previous fiscal year.

As the economy continues to improve, all signs point to an increase in tax revenue for the 2018 fiscal year. An increase in revenue, however, need not result in a loss of focus on prioritizing spending on core services.

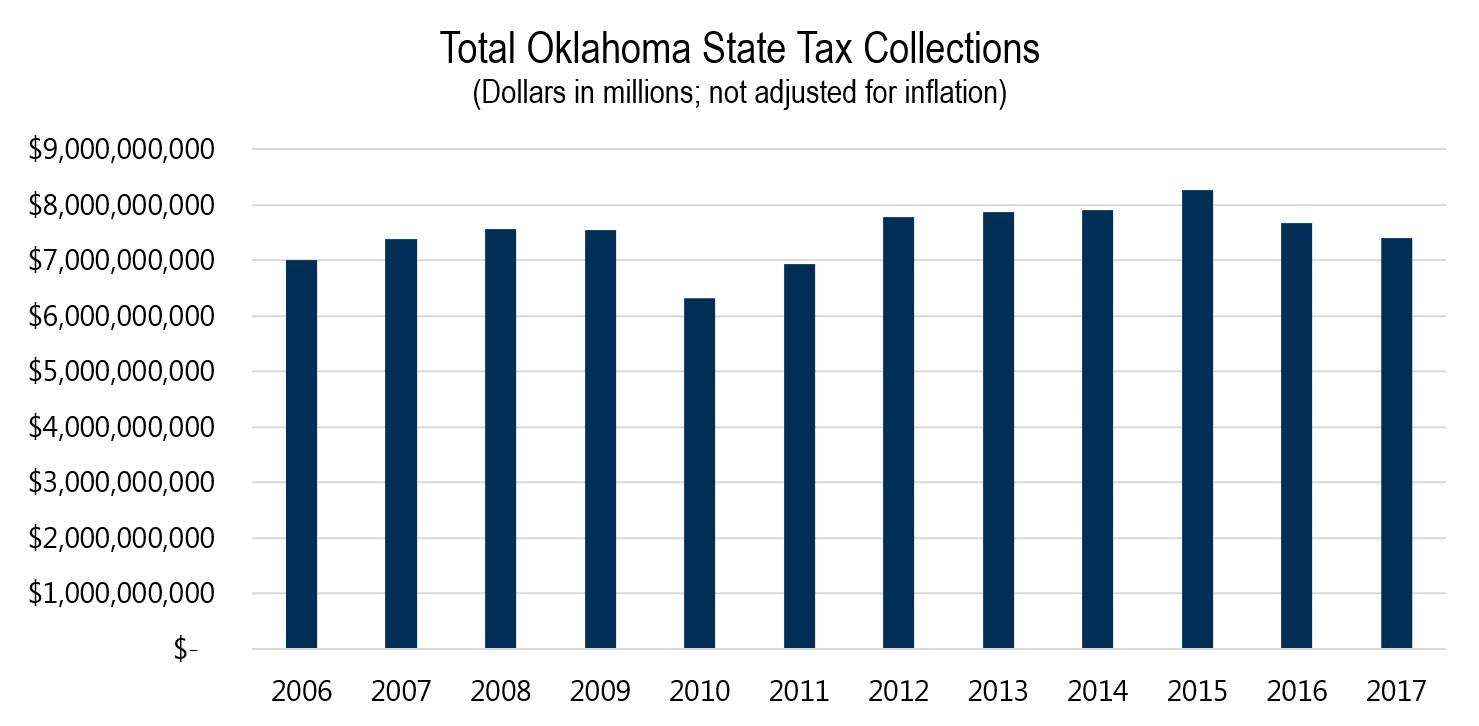

We have also included charts that show tax collections and government revenue in nominal dollars (not adjusted for inflation). Inflation adjustments account for an average loss in purchasing power over time. Federal policies intentionally cause inflation, making a dollar worth less and the nominal price of goods rise. Of course, some goods actually become less expensive due to improvements in technology and other changes in supply and demand. Adjusting government figures for inflation can create an excuse to raise taxes, even though taxpayers do not have the same luxury when it comes to their own paychecks.

When using nominal dollars, the difference in fiscal year 2016 and fiscal year 2017 tax collections falls to $276 million, but total government revenue growth increases $641 million in that same year.

Sources:

Curtis Shelton

Policy Research Fellow

Curtis Shelton currently serves as a policy research fellow for OCPA with a focus on fiscal policy. Curtis graduated Oklahoma State University in 2016 with a Bachelors of Arts in Finance. Previously, he served as a summer intern at OCPA and spent time as a staff accountant for Sutherland Global Services.