Budget & Tax

Lower oil prices hit January 2019 economic growth

February 15, 2019

Curtis Shelton

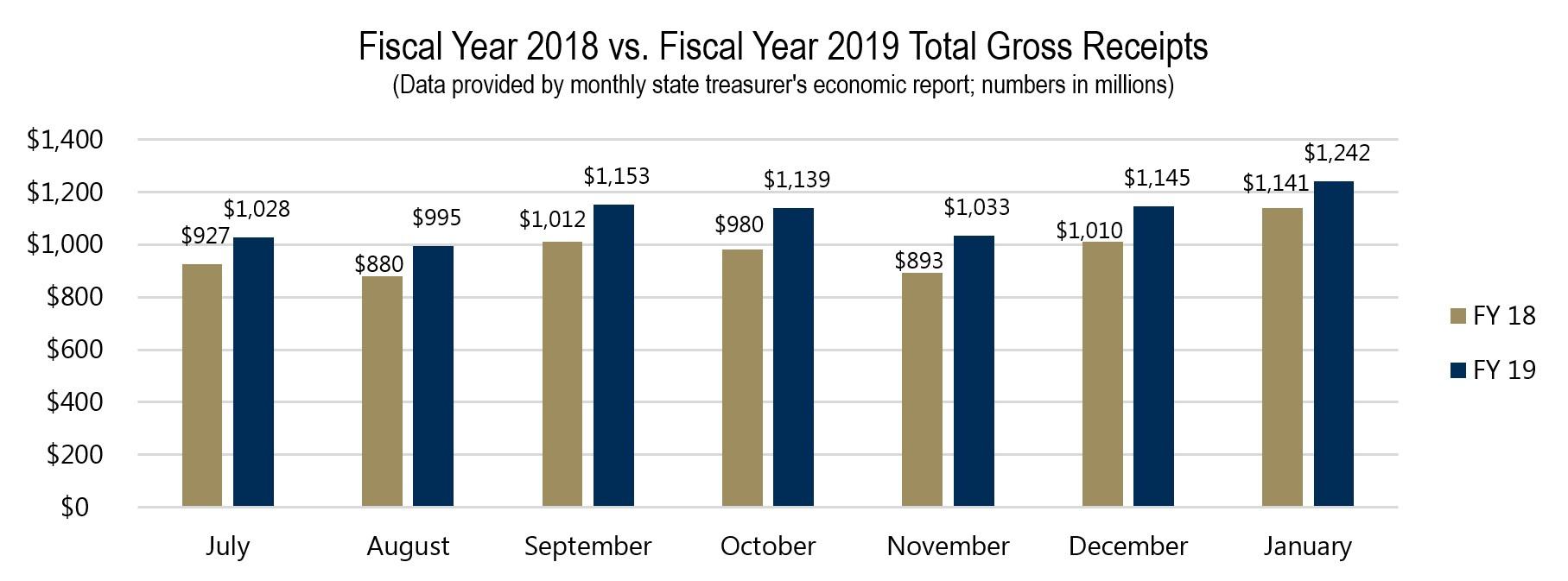

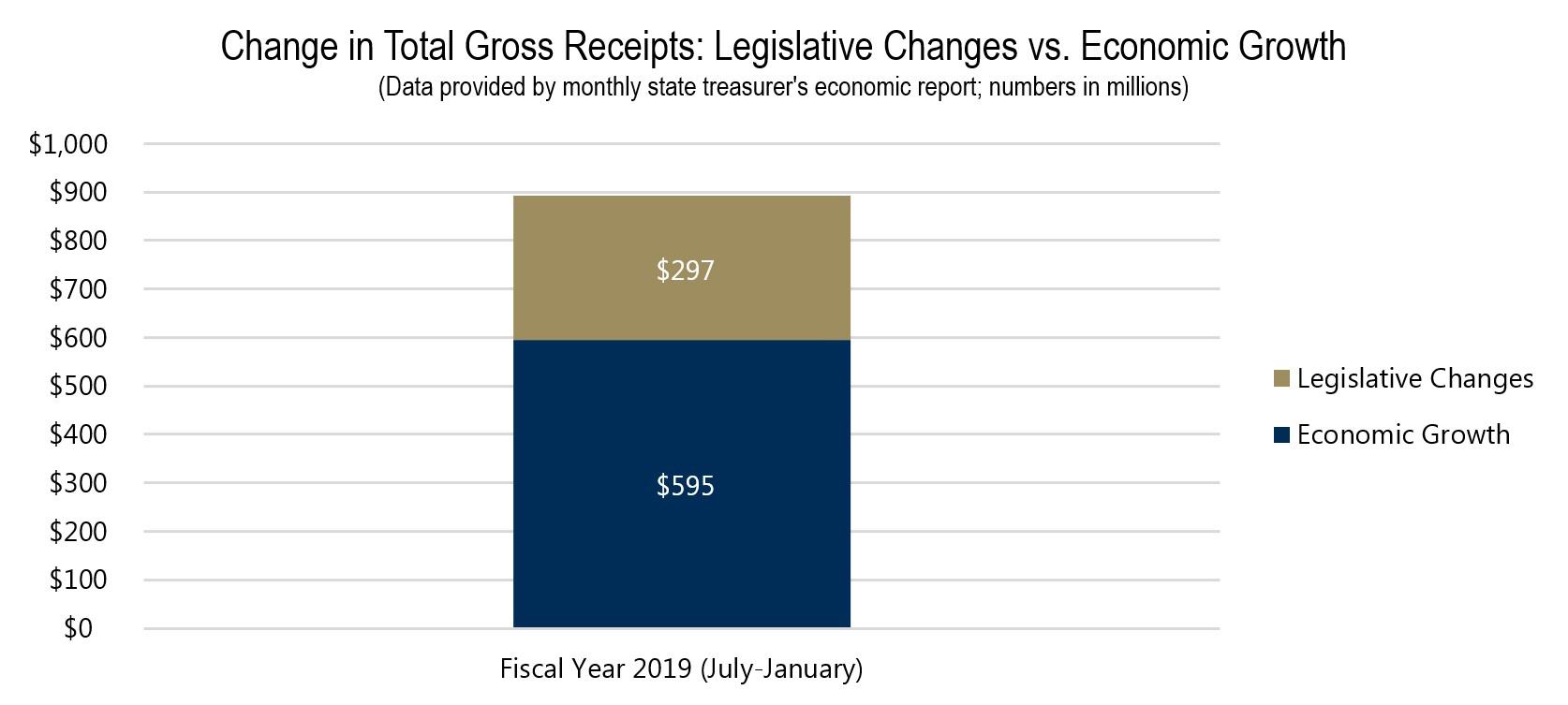

The Oklahoma State Treasurer released the monthly report for January 2019 revenue collections. The report shows Total Gross Receipts collected in January 2019 were $1.24 billion—an 8.9 percent, or $101 million, increase when compared to the same month from the prior year. Lower oil prices have slowed state revenue growth compared to prior years, although continued growth is still expected.

New revenue from House Bill 1010xx amounted to $50.3 million, or 50 percent, of the total growth for the month. The change in the gross production tax from 2 percent to 5 percent brought in the largest amount of new revenue at $32 million. The $1 increase for each pack of cigarettes brought in $8.4 million, while the six-cent increase in the diesel fuel tax brought in the smallest amount at $9.9 million. The other half of revenue growth was the result of economic growth.

Of the four major tax sources, the gross

production tax saw the largest percentage increase year-to-year at 64.7

percent. The income tax, along with motor vehicle taxes, saw the smallest

increase at 2.1 percent.

Gross production taxes were at their lowest point since the rate increase from 2 percent to 5 percent last year. While the economy continues to grow, the fall in oil prices has put the expansion on notice. While no major effects have been felt yet, volatile energy prices can have a major impact on how Oklahoma’s economy moves forward.