Budget & Tax

More people moving out of Oklahoma than moving in

April 16, 2019

Curtis Shelton

A recent analysis by Chad Wilkerson, vice president and Oklahoma City branch executive of the Federal Reserve Bank of Kansas City, and Courtney Shupert, Research Associate, shows that more people have been moving out of Oklahoma than moving in. This is a new trend that began a few years ago after Oklahoma experienced a decade of net growth from migration. While no state wishes to lose people, is this cause for alarm?

The report highlights how Oklahoma experienced faster population growth than the national average during the mid-2000’s and kept very near the average up until 2016. Over the last three years, however, Oklahoma’s population growth slowed to a mere 0.3 percent. This small increase was primarily due to natural growth (more births than deaths).

What’s been different over the last three years compared to the previous decade?

The price of oil.

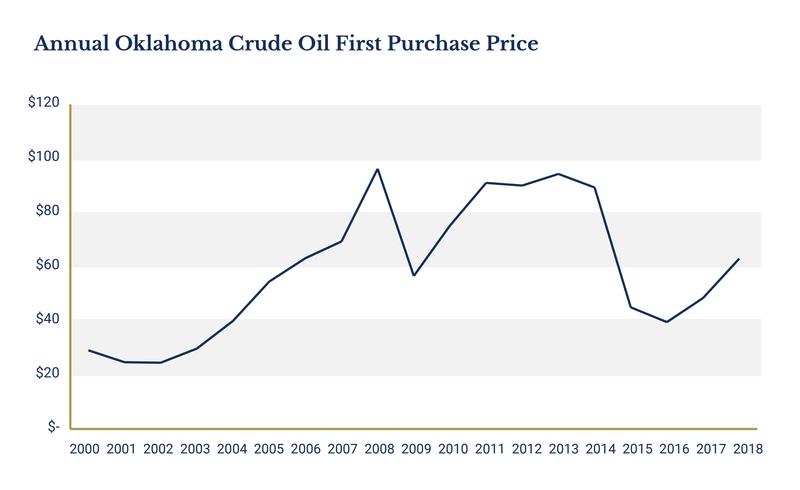

For good or ill, Oklahoma’s fortunes are heavily tied to the oil and gas industry. Throughout the early 2000s up until the Great Recession, crude oil prices climbed to a peak of $131 in the middle of 2008. Oil prices plummeted to under $40 per barrel, but quickly recovered a few months later and were over $60 by June of 2009. This is one of the reasons Oklahoma fared comparatively well during the Great Recession. Prices continued to climb back to $100 per barrel and stayed there until the beginning of 2015 when prices again plummeted to under $40 a barrel. Prices stayed low for much of the next two years and didn’t start rising until 2017, which began Oklahoma’s economic recovery. Correspondingly, the net domestic migration numbers improved for Oklahoma.

While energy prices play a major factor in Oklahoma, that was not the only significant change that occurred throughout this time frame. The income tax in Oklahoma was cut by 29%. This downward trend may also have helped to attract people to the state.

Starting with the Brad Henry administration in 2004 and continuing until 2016, the top marginal tax rate fell from 7 percent to 5 percent. Unsurprisingly, when given the choice between keeping more or less of their money, people overwhelmingly choose more. This might not be a novel idea, but IRS data collected by How Money Walks puts weight behind it.

How Money Walks shows how America’s wealth has moved since 1992. Overwhelmingly, states with a lower penalty on work have gained more than states with a high income-tax burden. The two states that have gained the most wealth are Florida and Texas, both of which do not levy an income tax. Of the six states the Fed’s reports show Oklahomans are moving to, four of them (Arizona, Washington, Florida, Colorado) have lower income-tax rates.

The last income tax cut took effect in 2016. At that point, the legislature was already in the process of raising taxes. From 2015 through 2018, Oklahoma taxes and other annual revenues went up by $1.1 billion.