Budget & Tax

The tax cut blame game

March 22, 2018

Curtis Shelton

Those who want higher taxes generally blame past tax cuts for Oklahoma’s recent budget challenges. They cast particular blame on cuts to state income tax rates. While OCPA has questioned the severity of these challenges, we have also researched the connection between tax cuts and revenue.

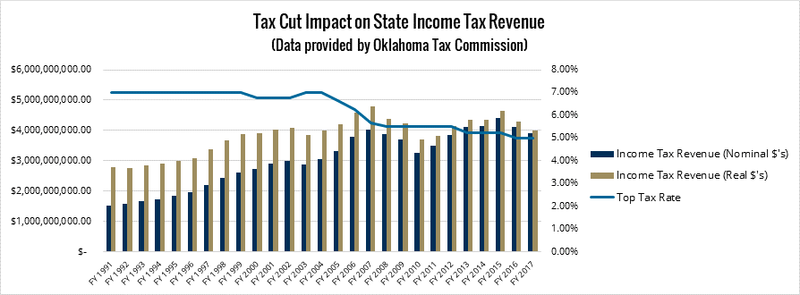

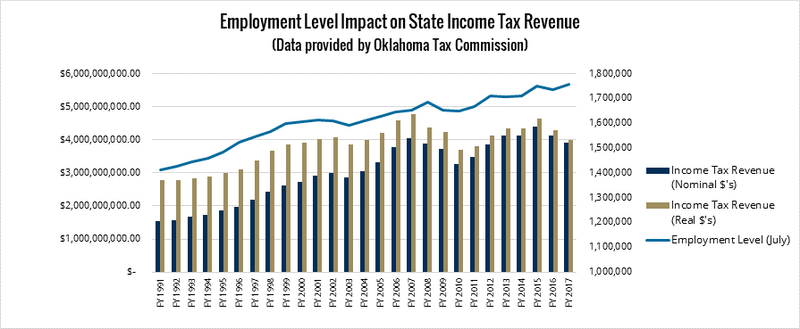

Data from the Oklahoma Tax Commission show that income tax revenue has grown from $1.54 billion in 1991 to $3.93 billion in 2017 despite cuts to the top marginal income tax rate over the same period of time, from 7% in 1991 to 5% in 2017. Even when adjusted for inflation, revenue has grown by 43% from 1991 to 2017. This growth in revenue correlates with the rise in employment in Oklahoma. As the graphs below show, employment has a much greater impact on income tax revenue. And, what seems surprising is that income tax rates have been found to have a negative correlation with revenue collections.

Most of these tax cuts occurred while Gov. Brad Henry was in office. In Fiscal Year 2003, the top income tax rate was 7%. By Fiscal Year 2008, the rate had been cut to 5.5%. This was just before the great recession began to dampen state revenues. During those six years, as the tax rate fell from 7% to 5.5%, revenues grew by $526 million when adjusted for inflation.

The rest of the tax cuts took place during Gov. Fallin’s time in office, and took the top rate from 5.5% in 2011 to 5% in 2017 (a .25% cut was approved by Henry and another signed by Fallin). Again, revenues grew; this time by $166 million when adjusted for inflation. Some might argue that these increases can all be explained by population growth, but per capita income tax revenues have grown as well since 1991. Per capita collections were $1,101.67 in 1991 and are now at $1,223.35 in 2017 when adjusted for inflation. Some of Oklahoma’s population growth may in fact be the result of tax cuts.

This idea that higher rates don’t always lead to more revenue, and lower rates don’t always lead to less revenue was first described by economist Arthur Laffer and is known today as the Laffer curve. It is important to understand that this theory does not mean that lower taxes rates will always lead to higher revenue, but that taxes change incentives. Higher taxes create a disincentive to do whatever is being taxed. Advocating for lower taxes as a way to increase government revenue misses the point. Simply maximizing government revenue should not be the goal of state fiscal policy. State government should only raise enough revenue to ensure that core functions of government are funded and do so in the least damaging way possible. The real focus of fiscal policy should be ensuring state government is operating as efficiently as possible before raising taxes is considered.

Sources: Oklahoma Tax Commission Annual Reports, https://data.bls.gov/pdq/SurveyOutputServlet