Budget & Tax

Spending restraint would save Oklahoma taxpayers billions

August 17, 2018

Joel Griffith

This article was published in OCPA's Perspective magazine View Issue

According to the National Association of State Budget Officers (NASBO), total state funds expenditures are expected to smash records in fiscal year (FY) 2018 for the seventh consecutive year, after rising from $11.5 billion in FY 2011 to $16.1 billion in FY 2017.

According to data from the Henry J. Kaiser Family Foundation, Oklahoma spends more per capita than 19 other states. In fact, for every $1 spent per capita in neighboring Texas, Oklahoma spends $1.30.

Certainly, Oklahoma’s three-quarters supermajority requirement for tax increases has greatly benefited taxpayers. Following its 1992 addition to the state constitution, this hurdle staved off many (not all) tax hikes for 26 years.

As Oklahoma adds to its tax burden (including the 15th highest sales tax burden, according to Rich States, Poor States™), other states continue down a different path. For instance, North Carolina slashed its corporate income tax rate nearly in half since 2012 from 6.9 percent to just 3 percent. Oklahoma now imposes twice the burden on businesses compared to the economic magnet to the east.

Given that legislators from both political parties have no appetite to bridle spending growth, alternatives are needed. A Taxpayer Bill of Rights (TABOR) constitutional amendment would impose far stricter requirements on state spending growth. In short, TABOR limits spending growth to inflation plus population growth, in addition to any voter-approved spending changes. Exceeding these limits requires a supermajority.

In the years since Colorado voters passed TABOR in 1992, taxpayers have benefited from more than $3.2 billion in refunds. Illustrating the flexibility of the limitations, voters did choose to lift the limitations temporarily from FY 2006 to FY 2010.

Limiting spending growth also reduces the perceived need to raise taxes in order to resolve budget crunches. Because economic growth typically exceeds the growth in inflation plus population, real tax revenue per capita increases in most years without any increase in tax rates. Politicians too often decide to spend this extra tax revenue rather than lower the tax burden accordingly.

To be clear, because spending may still increase at the rate of inflation plus population growth, TABOR limits do not result in budget cuts. Tax relief stemming from surpluses following TABOR implementation materializes simply as a result of typical real per capita increases in economic growth.

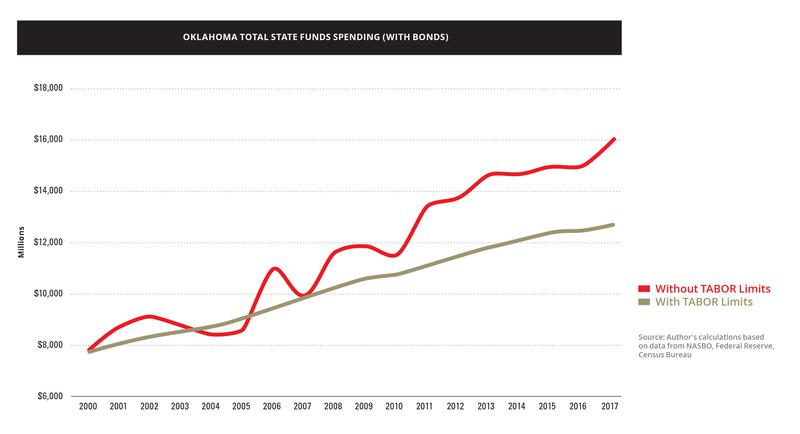

What would TABOR have meant for Oklahoma? Since 2000, total state funds spending would have increased just 56 percent rather than 108 percent if limited to just the combined growth in inflation (42 percent) and population growth (14 percent.) Failure to adhere to such basic constraints created a budget blowout of $16.1 billion in FY 2017, a whopping $3.6 billion higher than the $12.7 billion in spending the state would have had with TABOR-constrained growth.

">

In other words, total spending in FY 2017 was 27 percent higher than would have occurred with basic spending growth limitations. Since 2000, this lack of spending restraint resulted in $27 billion of additional spending—or nearly $6,900 in excess spending for every current resident.

Provision of essential government services and tax cuts are not mutually exclusive tasks. Modest changes to a spending-growth trajectory empower legislators to accomplish both. A supermajority requirement to expand real per capita government spending helps ensure that the taxpayer—rather than the bureaucracy—enjoys more fully the benefits of economic expansion.