Economy

Curtis Shelton | June 18, 2019

Tax cuts and economic growth

Curtis Shelton

Dr. Art Laffer, who tomorrow will be awarded the Presidential Medal of Freedom for his work in economics, is widely known for his theory of the Laffer Curve. The Laffer Curve posits that there can be a point at which the tax rate can be so burdensome a rate increase would result in lower tax revenue. It also theorizes the opposite is true, that a decrease in the tax rate can lead to increased tax revenue due to a rise in economic activity. Where a tax rate might be on this curve has been hotly debated in many different situations. The debate on whether or not a tax cut will increase revenue went on in Oklahoma throughout much of the last decade and a half, but this often misses the point. Cutting taxes is not a route to maximizing government revenue.

When Oklahoma reduced its personal income-tax rate under Governor Brad Henry, the purpose was not to increase tax revenue but rather to spur economic growth. As Gov. Henry said of the tax cuts at the time, the goal was to ensure that Oklahoma families “have more of their hard-earned dollars for savings and investment” and “to incentivize investment in and growth of Oklahoma companies and encourage the relocation of out-of-state corporate headquarters to Oklahoma.”

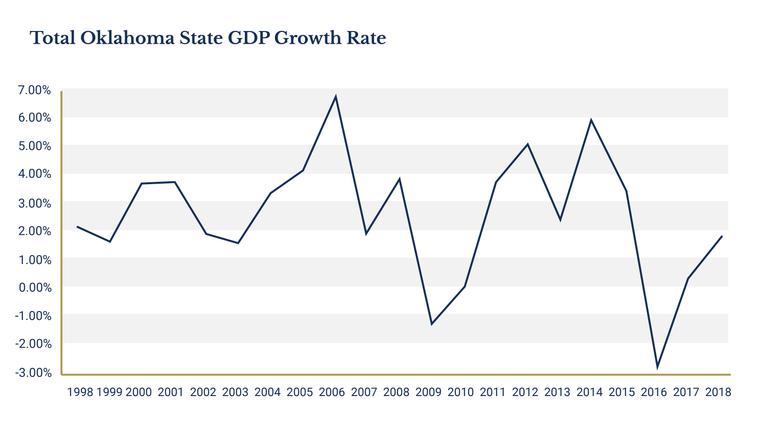

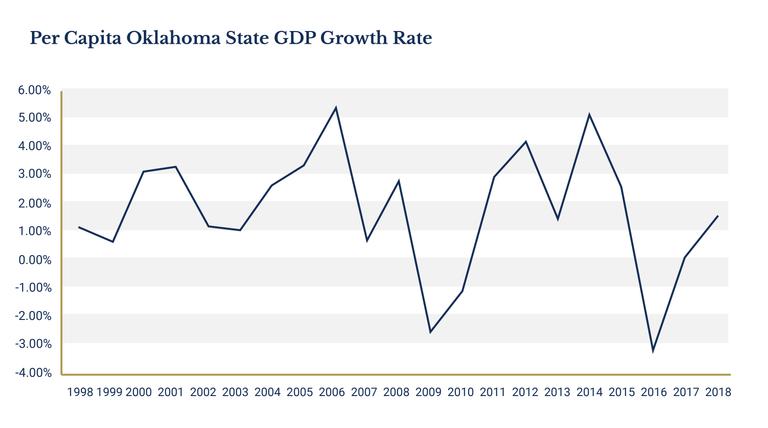

The data shows that once these tax cuts began to take effect the economy did in fact begin to grow. According to data from the Bureau of Economic Analysis, Oklahoma’s GDP, in terms of real dollars, grew at an average rate of 2.53 percent between 1998 to 2004, before the tax cuts began to take effect. The next four years, until the Great Recession began in 2009, state GDP grew at an average rate of 4.11 percent. When population growth is taken into account GDP still grew at a faster rate. The per capita GDP growth was 1.89 percent between 1998 and 2004, and then 2.99 percent over the next four years.

Income tax revenue also continued to grow after the income tax rate declined. It wasn’t until major recessions caused by the mortgage crisis in 2009 and the massive decline in the price of oil in late 2014 that Oklahoma tax revenue fell. It was these recessions, particularly the 2015 recession where 21,800 Oklahomans lost their job and $13 billion in taxable income was lost, that caused Oklahoma’s budget shortfalls, not a decline in the income tax rate.

To protect itself from future recessions and to enable a faster recovery when they do happen, Oklahoma must create a more diversified economy less reliant on one or two volatile industries. That is the real aim of tax cuts: enabling people to use more of their hard-earned resources and grow the economy, not the government.

Source: Bureau of Economic Analysis; data adjusted for inflation

Source: Bureau of Economic Analysis; data adjusted for inflation

Curtis Shelton

Policy Research Fellow

Curtis Shelton currently serves as a policy research fellow for OCPA with a focus on fiscal policy. Curtis graduated Oklahoma State University in 2016 with a Bachelors of Arts in Finance. Previously, he served as a summer intern at OCPA and spent time as a staff accountant for Sutherland Global Services.