Budget & Tax

Boom and bust: Oil and gas prices push and pull state tax collections

Curtis Shelton | December 5, 2018

Note: All data in this article have been adjusted for inflation using the Consumer Price Index.

Oklahoma’s economy has long relied on oil and natural gas. Fourteen percent of total household earnings came from oil and gas activity in 2014, according to the research firm RegionTrack. The oil and gas industry also increased its share of total state gross domestic product (GDP) to a peak of 15.04 percent. As oil and gas prices plummeted, that share has dropped to 8.04 percent in 2016, according to the most recent available data. As such a large share of the state economy, the oil and gas industry also has a significant impact on state revenues.

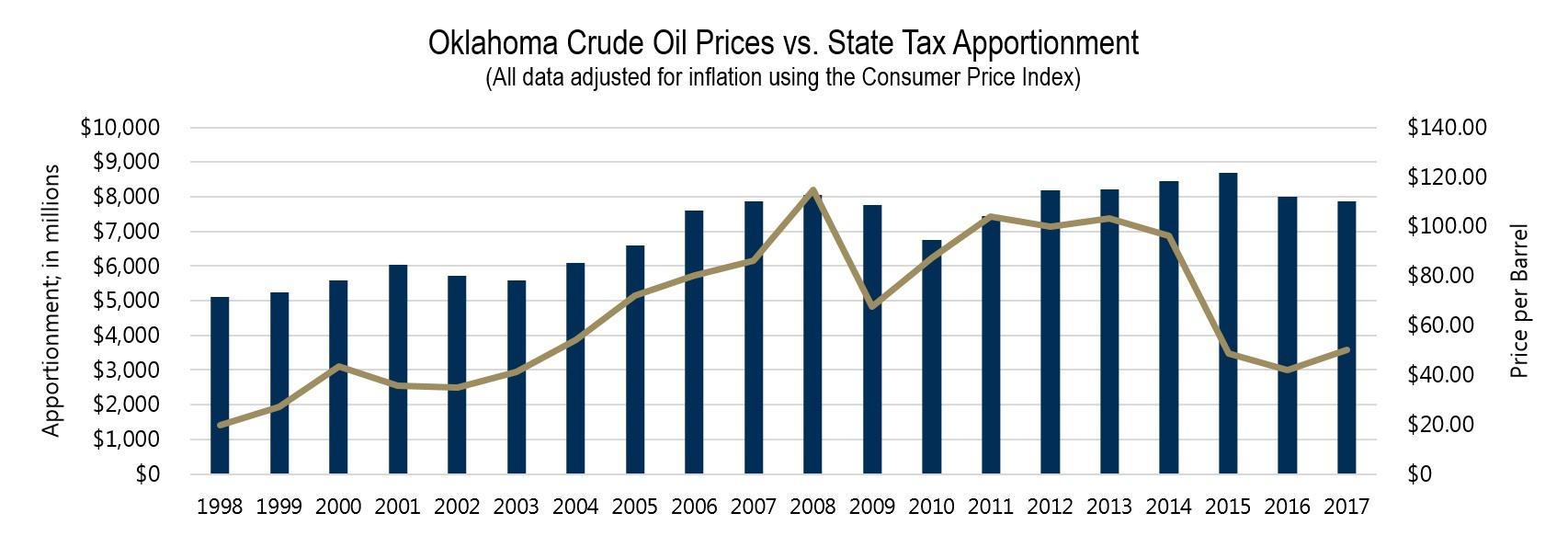

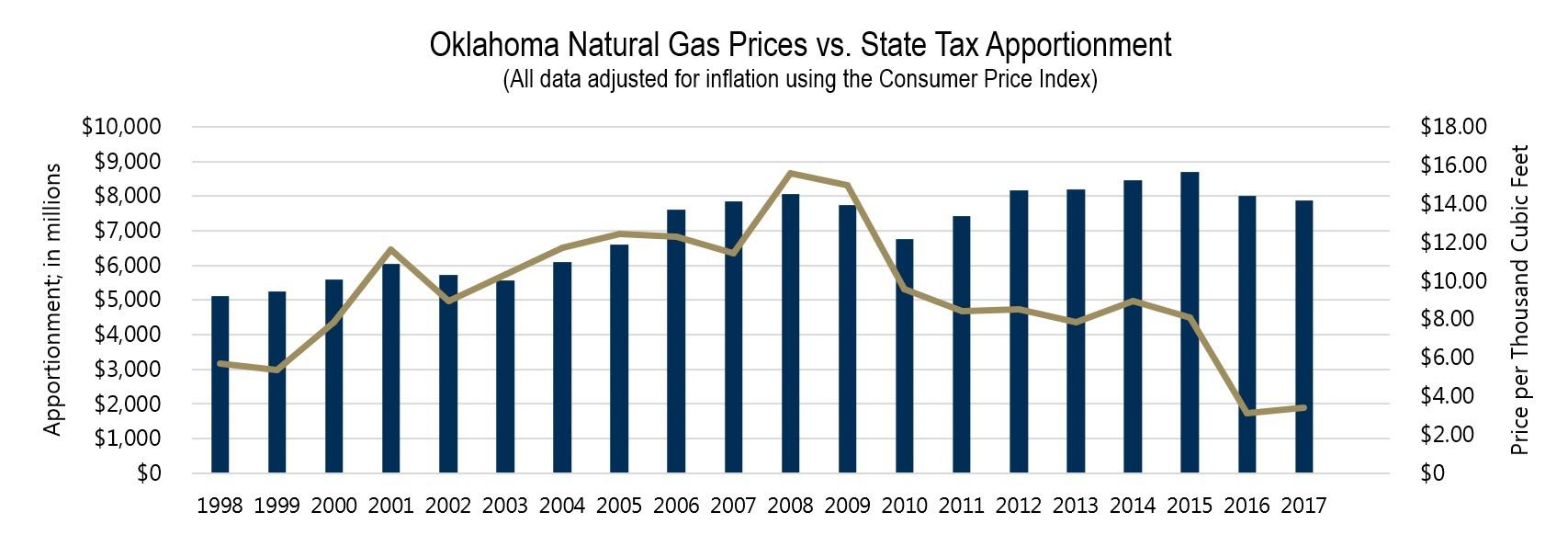

The two charts below show oil and natural gas prices for Oklahoma compared with state tax apportionment totals (the amount of money the Oklahoma Tax Commission deposits into various state funds or remits to counties and cities). As the charts show, these commodity prices have a correlation with state tax collections with a period of lag time before the price changes begin to affect tax collections. As oil and gas prices rise, so too do tax collections. Likewise, collections fall when prices fall.

From fiscal year 1998 to 2000, oil and gas prices rose (119 percent and 37 percent, respectively) while tax collections grew 9 percent. When prices fell, a decline began in state tax collections, dropping 8 percent from fiscal year 2001 to 2003. Oil and gas prices then steadily began to climb to a peak in 2008, with oil at $115 a barrel and natural gas at $15.57 per thousand cubic feet. During that time, tax collections grew by 44 percent. During the great recession, oil prices plunged 40 percent. Tax collections bottomed out in 2010, falling 16 percent. As the economy began to recover, there was again a stretch of rising oil and gas prices until 2015 when the recent drop in oil and gas prices began. This resulted in tax collections falling 10 percent from $8.7 billion to $7.9 billion.

As I have mentioned before, volatile revenue sources make budgeting difficult. Relying heavily on the oil and gas industry can lead to the sizable growth reflected in the current state economy. It can also become a serious drag on the state, like what was experienced over the last few fiscal years. Stabilizing tax collections would reduce the chance of severe budget shortfalls or surpluses. This, in turn, would lower the call for short-term solutions via quick tax increases in bad times or expanding crony tax incentives in good times. A long-term approach that sets Oklahoma on a path towards a more diversified economy and tax base will give all Oklahoma taxpayers and businesses a better chance to prosper.

Sources:

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=f002040__3&f=m

Curtis Shelton

Policy Research Fellow

Curtis Shelton currently serves as a policy research fellow for OCPA with a focus on fiscal policy. Curtis graduated Oklahoma State University in 2016 with a Bachelors of Arts in Finance. Previously, he served as a summer intern at OCPA and spent time as a staff accountant for Sutherland Global Services.