Law & Principles

Keep an Oklahoma win in Congress’s One Big, Beautiful Bill: Closing the tobacco double-drawback loophole

Jonathan Small | June 17, 2025

The "double drawback" loophole is a technical policy within federal trade law that is not widely known, yet it has a surprising connection to Oklahoma. The repeal of this loophole was included in the version of the One Big, Beautiful Bill that passed the House, where it was seen as a win for domestic tobacco manufacturers and a repeal of an accidental and unfair trade policy.

However, in the Senate draft of the bill released Monday evening, the language to repeal the loophole has been omitted. This change is bad news for Oklahoma because it leaves domestic companies, including one based in Pryor, at a significant disadvantage compared to foreign tobacco firms that exploit the loophole. Closing this unfair loophole is crucial for protecting jobs and wages in Oklahoma and ensuring a level playing field for American businesses.

What is Double Drawback?

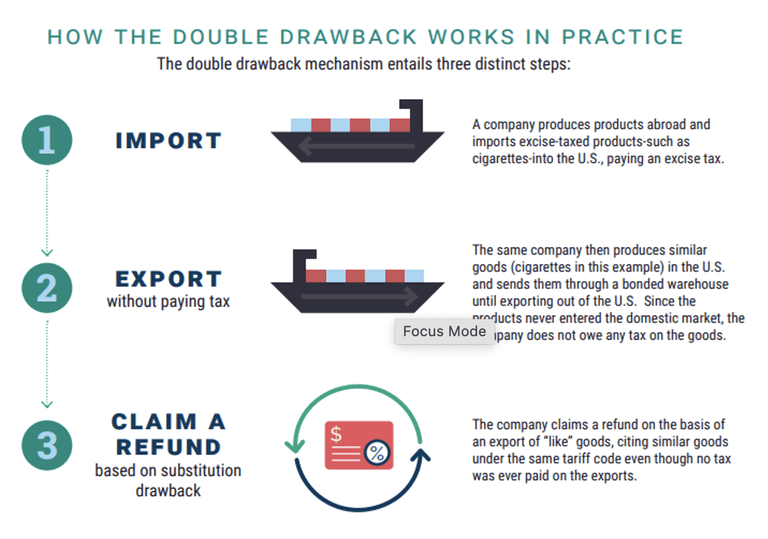

Double drawback is a loophole in trade law that allows certain foreign tobacco companies to sell cigarettes in the U.S. effectively federal excise tax-free by a quirk in the “substitution drawback” system.

The way it works has two steps. First, a company imports foreign-made cigarettes and pays a $1.01 per pack excise tax when they enter the U.S. market (all good so far). Second, the same company manufactures another batch of cigarettes in the U.S. and exports them via a bonded warehouse, which allows for exportation without paying an excise tax (still fine, as excise taxes should only be paid on domestically consumed products). But then, finally, the double drawback loophole allows companies to claim a $1.01 excise tax “refund” on their exported merchandise, even though those exports never paid an excise tax.

Congress has the opportunity to ensure that foreign tobacco companies pay the same taxes as domestic ones.

In effect, this means the company gets back the excise tax they paid on the initial imported products that are being consumed in the U.S., which gives these multinational companies a huge competitive advantage over U.S.-based domestic firms.

This loophole was pretty clearly a legislative accident: it emerged from decades of amendments to federal trade law and a critical 2021 court ruling. What we are left with is a weird set of incentives where if companies can just swap their supply chains—produce U.S.-consumed goods abroad and abroad-consumed goods in the U.S.—they can unlock billions in straight cash subsidies from the Treasury.

How many billions? The sky is really the limit here. The federal excise tax on cigarettes collected $8.5 billion in revenue in FY 2024, so it is hypothetically possible that if enough gaming of this loophole occurs in the industry, all of that revenue is at stake.

The Joint Committee on Taxation estimates that closing the loophole would save the Treasury $12.1 billion in revenue over 10 years, with their estimate growing each year of the score. This is hardly the biggest provision in the landmark bill, but for the companies in the space, the loophole is a significant cost differentiator, and one with the power to upend and distort the market: exactly what tax policy should never do.

How Double Drawback Hurts Domestic Companies

Xcaliber LLC, based in Pryor, is a prime example of a company that suffers under the current policy. Unlike foreign tobacco companies, Xcaliber does not have overseas manufacturing operations and cannot take advantage of the double drawback loophole. This puts them at a competitive disadvantage, as foreign companies can effectively sell their products at lower costs by avoiding excise taxes. If this loophole is allowed to persist, companies like Xcaliber could be completely overtaken, threatening jobs and wages in Oklahoma.

The repeal of double drawback is not just about increasing revenue—it’s about restoring neutrality to America’s tax and trade policy. It is also completely consistent with free-market principles—if you are going to levy taxes like excise taxes, they should be evenly applied to all firms, not arbitrarily lower on foreign importers.

This policy correction has bipartisan support and was even attempted through agency regulation during the first Trump Administration. A court ruling in 2021 prevented that route, but now Congress has the opportunity to act and ensure that foreign tobacco companies pay the same taxes as domestic ones.

We should be proud of Oklahoma companies that manufacture domestically and contribute to our state’s economy with jobs and investment. Closing the double drawback loophole is not just good policy—it’s essential for a level playing field for American businesses.

Source: Ike Brannon and Jeff Patch, “The Legal and Economic Case for Ending the Double Drawback Loophole”

Jonathan Small

President

Jonathan Small, C.P.A., serves as President and joined the staff in December of 2010. Previously, Jonathan served as a budget analyst for the Oklahoma Office of State Finance, as a fiscal policy analyst and research analyst for the Oklahoma House of Representatives, and as director of government affairs for the Oklahoma Insurance Department. Small’s work includes co-authoring “Economics 101” with Dr. Arthur Laffer and Dr. Wayne Winegarden, and his policy expertise has been referenced by The Oklahoman, the Tulsa World, National Review, the L.A. Times, The Hill, the Wall Street Journal and the Huffington Post. His weekly column “Free Market Friday” is published by the Journal Record and syndicated in 27 markets. A recipient of the American Legislative Exchange Council’s prestigious Private Sector Member of the Year award, Small is nationally recognized for his work to promote free markets, limited government and innovative public policy reforms. Jonathan holds a B.A. in Accounting from the University of Central Oklahoma and is a Certified Public Accountant.