Law & Principles, Economy

Montana’s inflation-indexed minimum wage squeezes small businesses

Curtis Shelton | January 7, 2026

Visit www.sq832killsjobs.com to learn more about SQ 832.

Ever since Montana tied its minimum wage to inflation, it has become noticeably harder for businesses in the Treasure State to survive.

Starting in 2007, Montana began increasing its minimum wage based on how much the Consumer Price Index increased the year prior. Between 2007 and 2019, before the pandemic, Montana's minimum wage rose 38 percent from $6.15 to $8.50 an hour, and it became harder for businesses to make it as the wage increased.

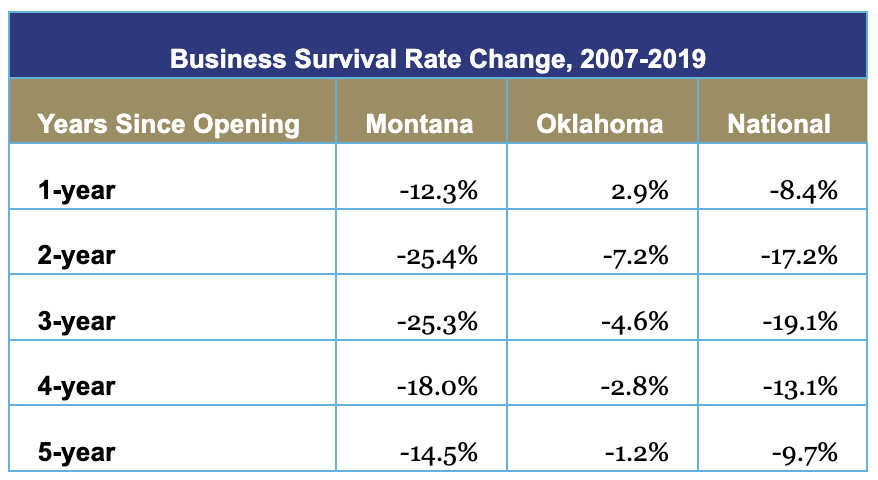

Over that period, the five-year survival rate for businesses declined by 14.5 percent, and the likelihood of a business surviving just one year fell by 12.3 percent. Both of those numbers were greater than the national averages of 9.7 percent for five-year survival and 8.4 percent for one-year survival.

Oklahoma, where the minimum wage stayed flat, experienced a small 1.2 percent decline between 2007 and 2019 for its 5-year survival rate, with the 1-year survival rate growing 2.9 percent. This is much better than the national average and a sign of a healthy entrepreneurial environment.

Since 2020, we have seen a massive rebound in not only business formation but survival rates as the economy experienced a massive shift in work. Montana and Oklahoma both saw a surge in 1-year survival rates, with Oklahoma still outperforming Montana according to the latest available data.

Montana also saw a decline in its labor participation rate among young workers. Since 2007, the labor rate for 16- to 24-year-olds has declined 8.58 percent. Again, Oklahoma beat out Montana with a small decline of 1.74 percent.

The reality is that the true minimum wage is always zero because no firm is required to hire anyone. The more expensive it becomes to hire young and inexperienced people, the less likely it is that firms will hire those people. It also makes it harder for small businesses to expand and scale up when labor costs continually rise without adding more employees.

If Oklahoma wants more jobs, more small businesses, and more wealth for everyone, it should reject the policy proposed in SQ 832.

Curtis Shelton

Policy Research Fellow

Curtis Shelton currently serves as a policy research fellow for OCPA with a focus on fiscal policy. Curtis graduated Oklahoma State University in 2016 with a Bachelors of Arts in Finance. Previously, he served as a summer intern at OCPA and spent time as a staff accountant for Sutherland Global Services.