Budget & Tax

Report: State economy grows even as oil prices remain low

Curtis Shelton | March 12, 2019

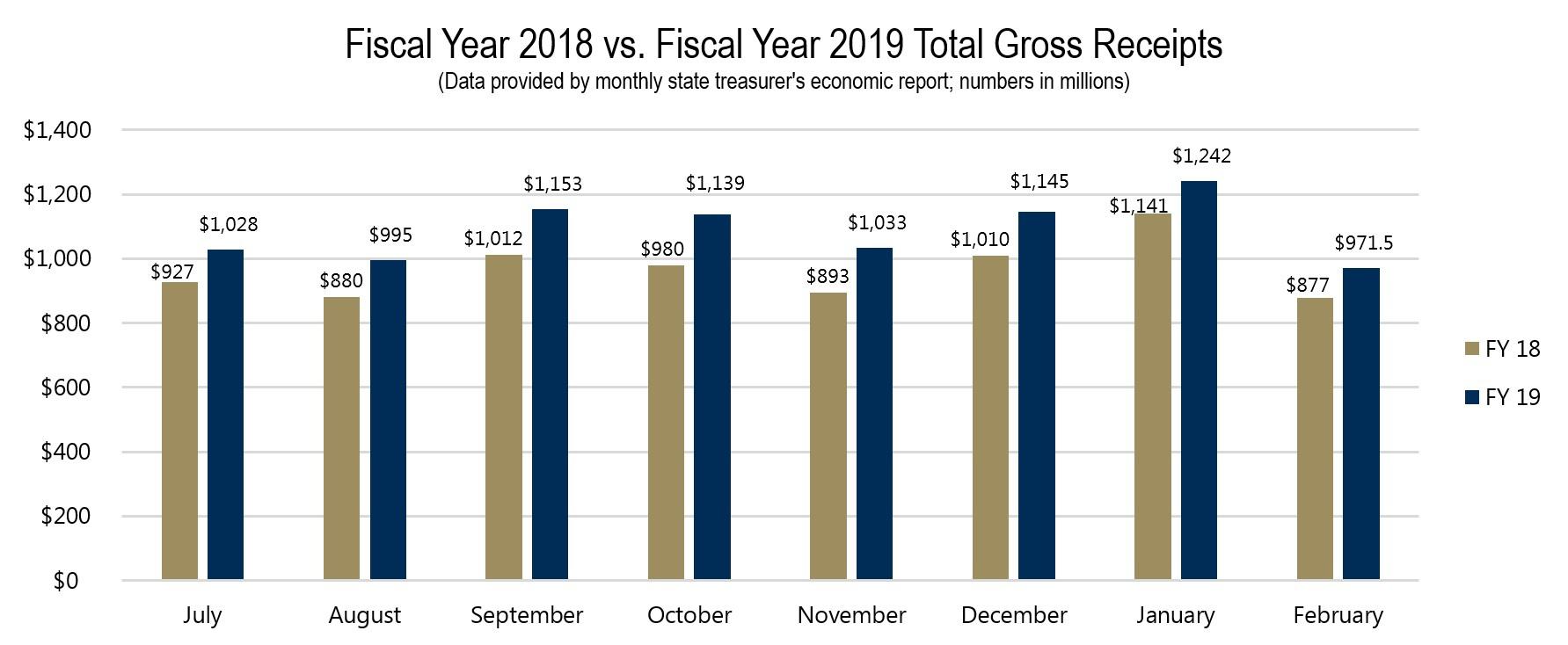

The Oklahoma State Treasurer released the monthly report for February 2019 revenue collections. The report shows Total Gross Receipts collected in February 2019 were $972 million—a 10.7 percent increase, or $94 million more, versus the same month last year. Of the four major tax sources, the gross production tax saw the largest percentage increase year-to-year at 58.3 percent. The sales tax saw the smallest increase at 1.5 percent.

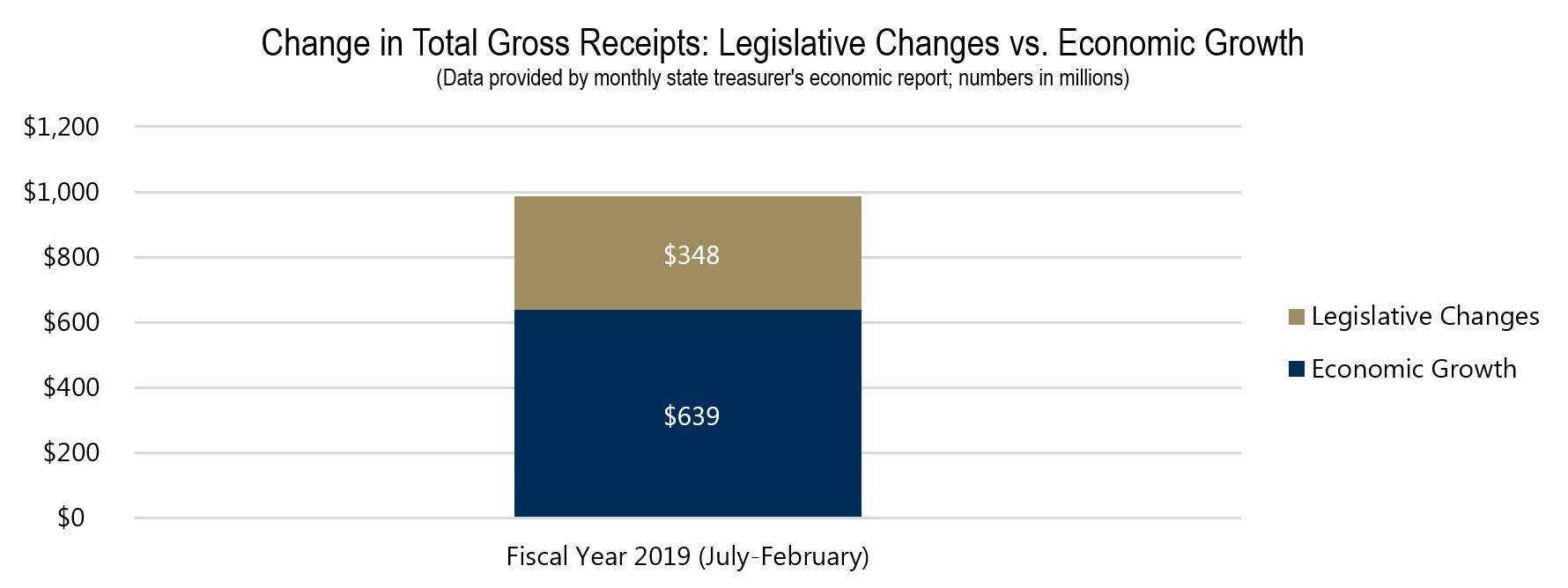

New revenue from House Bill 1010xx amounted to $50.7 million, or 54 percent, of the total growth for the month. This is the first time legislative changes made up more than 50 percent of revenue growth. The change in the gross production tax from 2 percent to 5 percent brought in the largest amount of new revenue at $33 million. The $1 increase in a pack of cigarettes brought in $10.5 million, while the six-cent increase in the diesel fuel tax brought in the smallest amount at $7.1 million.

Since the beginning of the fiscal year, economic growth has resulted in the state collecting $639 million more in revenue than for the same period in the prior fiscal year. Tax increases and other legislative changes have resulted in $348 million more in state revenue for the same period.

These collections were made in December 2018 when oil prices were at $49.52 per barrel (according to WTI), $21 below the July 2018 peak. Despite this, all revenue streams have grown compared to the prior year. This is a welcome sign that Oklahoma may be in a better position to weather lower energy prices than the last decline in 2015.

Curtis Shelton

Policy Research Fellow

Curtis Shelton currently serves as a policy research fellow for OCPA with a focus on fiscal policy. Curtis graduated Oklahoma State University in 2016 with a Bachelors of Arts in Finance. Previously, he served as a summer intern at OCPA and spent time as a staff accountant for Sutherland Global Services.