Budget & Tax

State appropriations vs. total Oklahoma government spending

Curtis Shelton & Dave Bond | May 15, 2018

Note: This originally ran on July 10, 2017. It has been updated with new data.

In discussions about taxes and state government

spending in Oklahoma, some advocates insist that available funding has been

slashed to the bone for important public services.

However, the claim is simply not true. While state appropriations in Oklahoma have fallen below previous years, total state government spending has shown consistent growth—more than $2.5 billion higher than 10 years ago (all numbers in nominal terms).

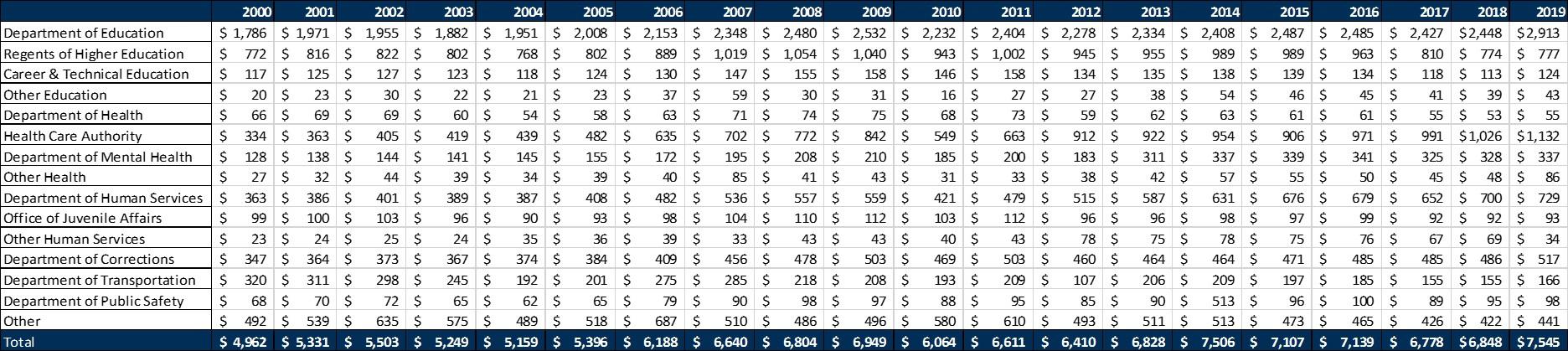

It’s important to understand the difference between state appropriations and total state government spending. State appropriations make up “the state budget” that lawmakers at the Oklahoma Capitol vote on every legislative session in order to provide a portion of the funding for specific state agencies.

Total state spending, on the other hand, is the sum of all the many different sources of funding that flow to—and are spent by—Oklahoma’s state government agencies each year. This includes state appropriations, as well as federal grants, non-appropriated spending, “off the top” apportionments, and more. For the last several years, state appropriations have made up only about 40% of total state government spending in Oklahoma.

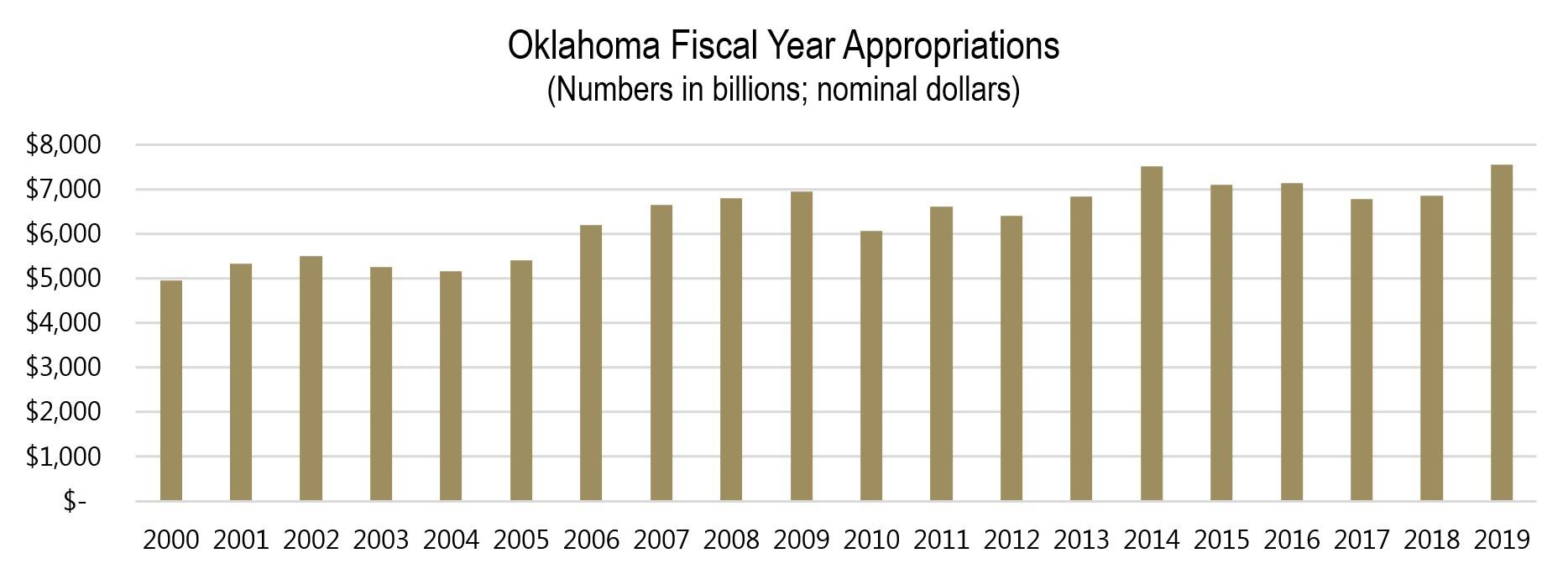

Oklahoma’s state government operates on a fiscal year that runs July 1 through June 30. For fiscal year 2010, which began July 1, 2009, lawmakers at the state Capitol appropriated $6.1 billion. For fiscal year 2019, lawmakers will appropriate $7.55 billion.

So, Oklahoma state lawmakers are set to appropriate $1.48 billion more for state services in fiscal year 2019 than they had 12 years prior, an increase of more than 24%.

While recent fiscal year appropriations have fluctuated, fiscal year 2019 is set to be the highest appropriation since 2014 when adjusting for inflation.

Some key economic factors help to explain the variance in state appropriations: In fiscal year 2008, the price of West Texas Intermediate (WTI) crude oil topped $133 per barrel, an all-time high, dramatically benefitting Oklahoma’s economy—and tax collections.

Oil prices were also historically high in 2013 and 2014, benefiting Oklahoma tax collections and appropriations considerably. In August 2013, the price of WTI crude oil rose to $106 per barrel. In June 2014, the price exceeded $105 per barrel.

Then, as 2014 progressed, oil prices plummeted as Saudi Arabia and other OPEC member nations, in effect, imposed economic sanctions on U.S. shale drilling states, including Oklahoma. Over the next two years, tens of thousands of Oklahomans lost employment in the energy sector. A number of Oklahoma-based energy companies declared bankruptcy.

These developments hit the state’s economy—and tax collections—hard. With this in mind, it shouldn’t be a surprise that appropriations for Oklahoma’s state government today are less than when oil prices regularly exceeded $100 per barrel.

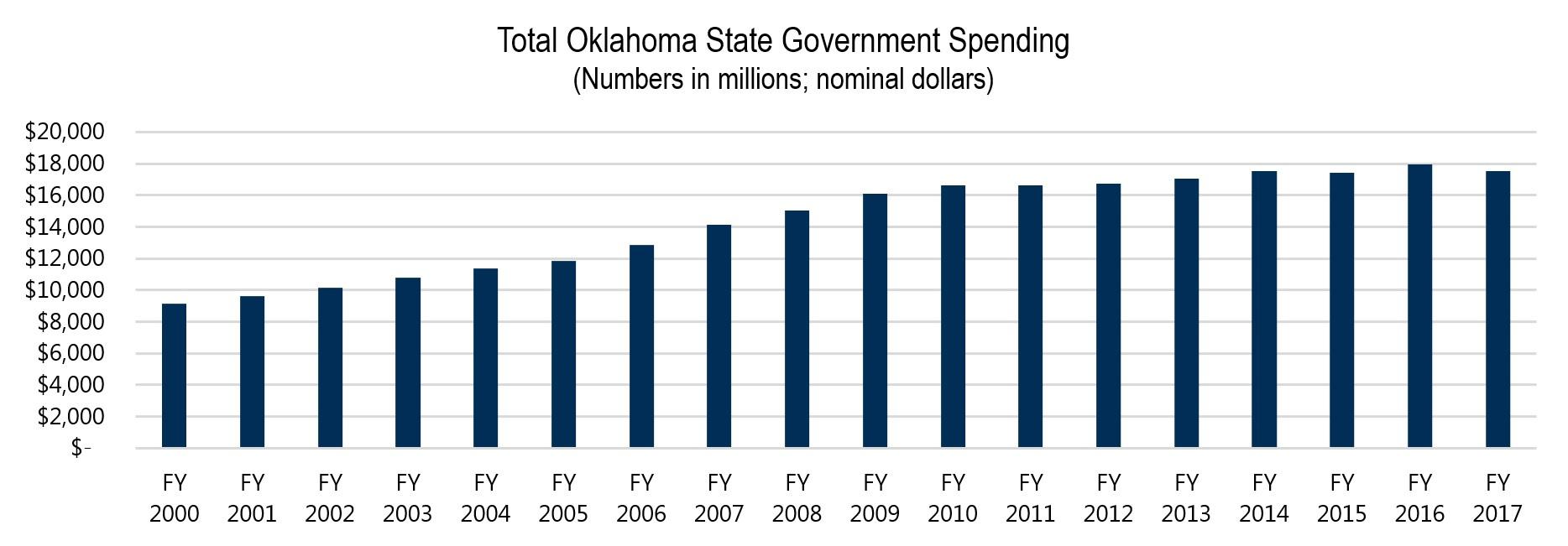

What may surprise some, however, is that total annual spending by Oklahoma’s state government has consistently risen over the last ten years. Even when adjusting for inflation, total spending has remained relatively stable despite the loss of federal stimulus money and the decline in oil prices.

In fiscal year 2008, total spending by Oklahoma’s state government was $15.02 billion. In fiscal year 2017, the most recent fiscal year for which full data are available, total state government spending in Oklahoma topped $17.53 billion.

In other words, total state government spending in Oklahoma is $2.5 billion higher today than ten years ago, an increase of 17%.

The consistent rise in total state government spending in Oklahoma is fascinating for several reasons. First, it does not correlate with state appropriations, which rose and fell from year to year.

Second, it does not correlate with outside economic factors, such as oil prices, on which Oklahoma’s economy often hinges.

Third, it was apparently not affected by the drop-off in federal government spending in Oklahoma following the tailing off of the 2009 Obama stimulus, which temporarily pumped hundreds of millions of federal dollars into the state beginning in 2009.

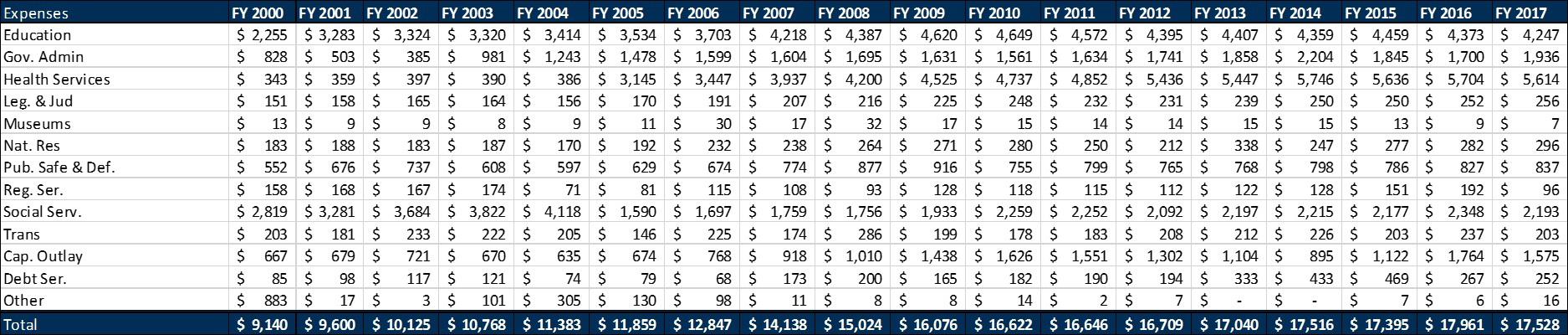

It’s also worth pointing out that reductions in recent years in state spending on education, as well as reductions in state spending on transportation infrastructure, can be attributed almost entirely to skyrocketing levels of state spending on health care.

Since fiscal year 2006, the amount of total annual state government spending in Oklahoma on health care has increased by a whopping $2.22 billion, or 63%. By comparison, median household income growth in Oklahoma grew by only 27% during that same period, according to the U.S. Census Bureau.

The escalation in health care spending by Oklahoma’s state government has devoured funding for other state services, including schools, roads, bridges, prisons, and more.

OCPA has also taken a look at appropriations and total state spending when adjusting for inflation.

Sources:

https://www.ok.gov/OSF/Comptroller/Financial_Reporting.html

http://www.oklegislature.gov/BillInfo.aspx?Bill=SB1600&Session=1800

Curtis Shelton

Policy Research Fellow

Curtis Shelton currently serves as a policy research fellow for OCPA with a focus on fiscal policy. Curtis graduated Oklahoma State University in 2016 with a Bachelors of Arts in Finance. Previously, he served as a summer intern at OCPA and spent time as a staff accountant for Sutherland Global Services.

Dave Bond

Vice President for Advocacy

Dave Bond serves as Vice President for Advocacy at the Oklahoma Council of Public Affairs. He was previously the CEO of OCPA Impact, OCPA's 501(c)4 action partner. Since 2011, Dave has advocated at the Oklahoma Capitol on issues of free enterprise, individual initiative and limited government. He has been referred to in the Tulsa World as "a prominent Oklahoma anti-tax lobbyist". Prior to his advocacy efforts, Dave worked in Oklahoma elections, focused mostly on state legislative campaigns. He was the executive director of the Republican State House Committee, the campaign arm of the Republican caucus of the Oklahoma House of Representatives. Dave also worked with the campaign consulting firm A.H. Strategies and with the inaugural campaign of former Corporation Commissioner Jeff Cloud. In addition, he served in the media and communications divisions of the Oklahoma House of Representatives. Dave has lived in Oklahoma most of his life and is a graduate of Oklahoma State University. He and his wife Marsha have two sons and live in Yukon.