Budget & Tax

Curtis Shelton | February 13, 2019

State budget primer: Context for the budget debate

Curtis Shelton

Note: All numbers in this article have been adjusted for inflation using Dec. 2018 dollars.

With the 2019 legislative session underway, the state budget once again takes center stage. We have already provided several important terms to help you understand the budget conversation. Now, we’ll look at past budget numbers to provide some context for this year’s budget debate.

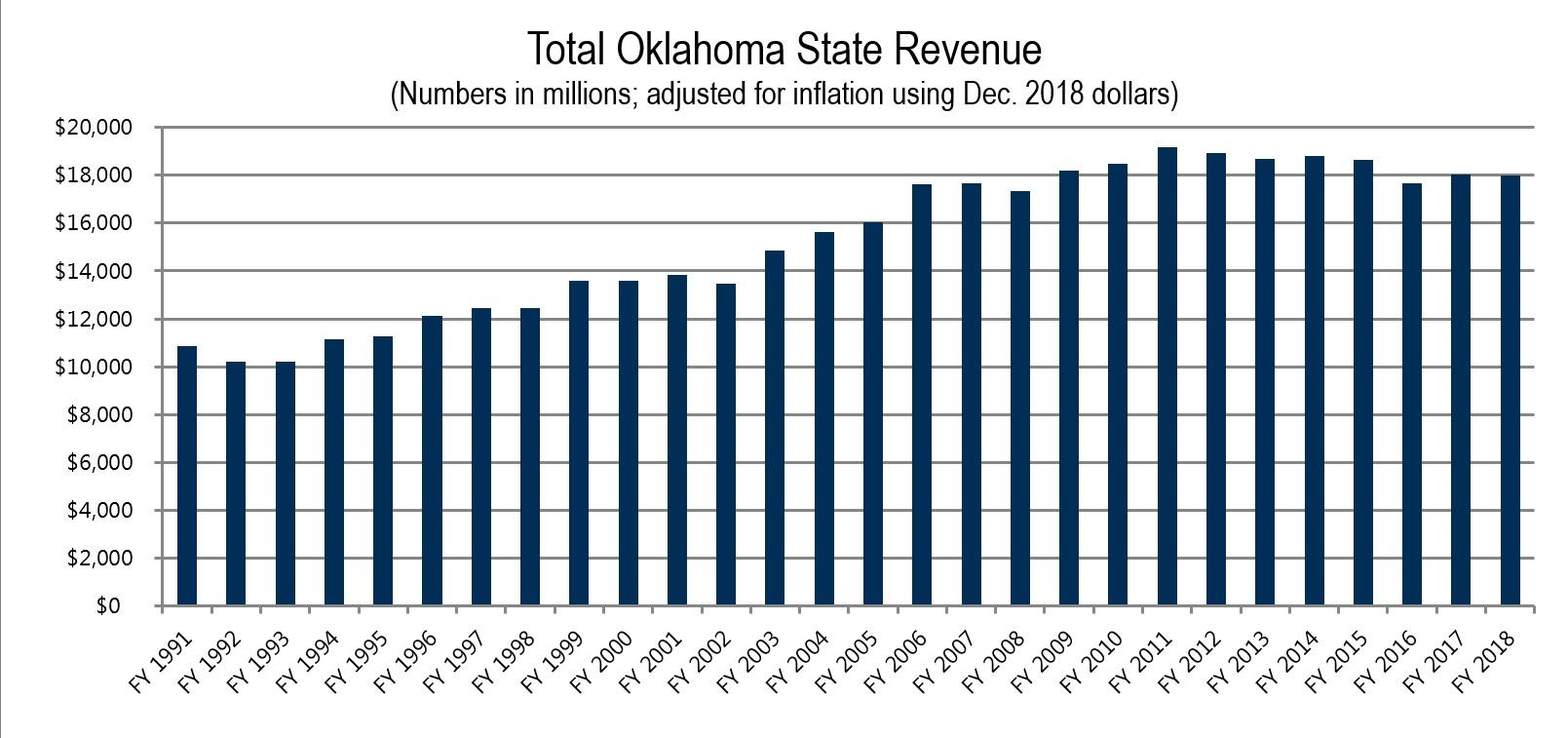

Total State Revenue:

Total Oklahoma state revenue has grown by $7.1 billion, or 66 percent, since fiscal year 1991. Total revenue is comprised of state taxes, agency fees, federal grants, and investment revenue. State revenue grew consistently throughout the 1990s until fiscal year 2002 as the nation entered a recession. From there, state revenue began a much faster growth rate, rising by more than $5.7 billion between fiscal year 2002 and fiscal year 2011. State revenue peaked in fiscal year 2011 at just over $19 billion, boosted by an increase in federal dollars from the Obama administration during the Great Recession. Revenue then began a gradual decline as those federal dollars left the state until fiscal year 2016 when revenue fell by nearly $1 billion after oil and gas prices plunged. As the state’s economy has continued to recover, state revenues have risen back up to $18 billion.

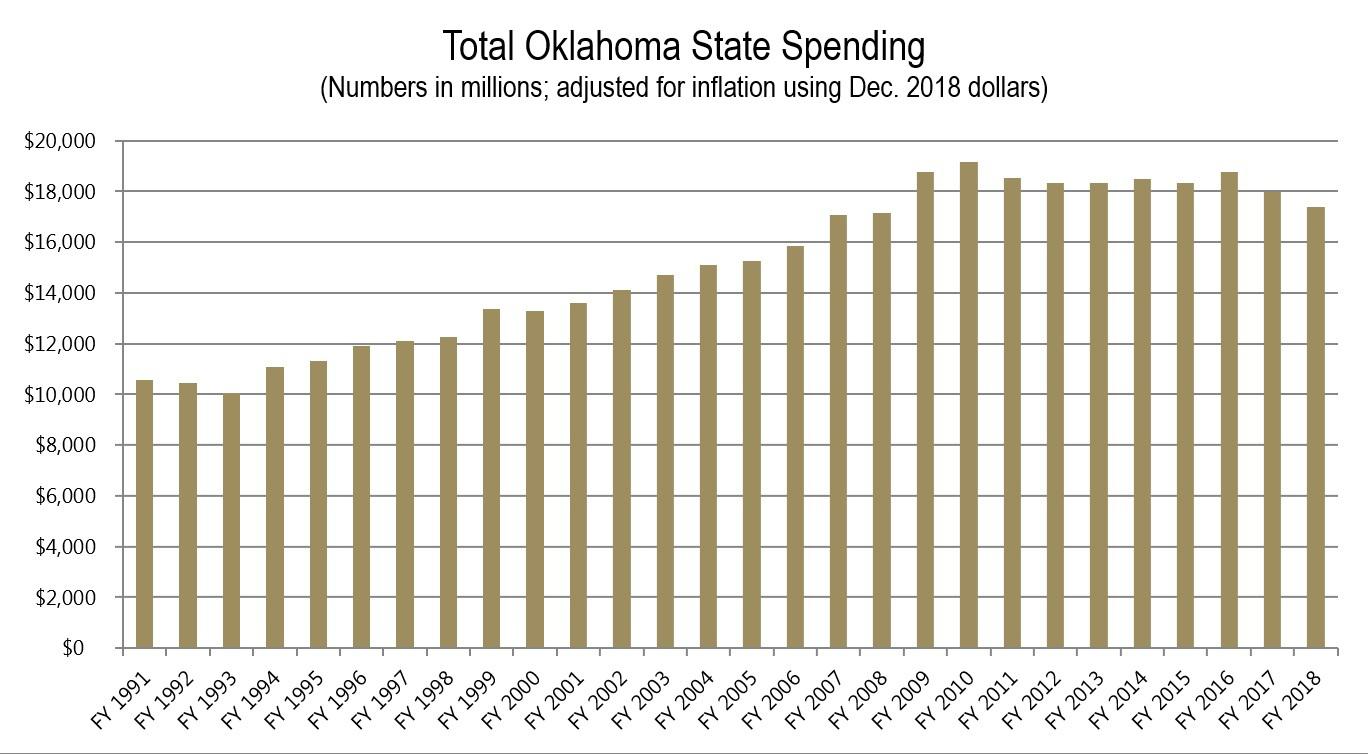

Total State Spending:

Total Oklahoma state spending has grown by $6.8 billion, or 64 percent, since fiscal year 1991. Total state spending was $17.32 billion in fiscal year 2018.

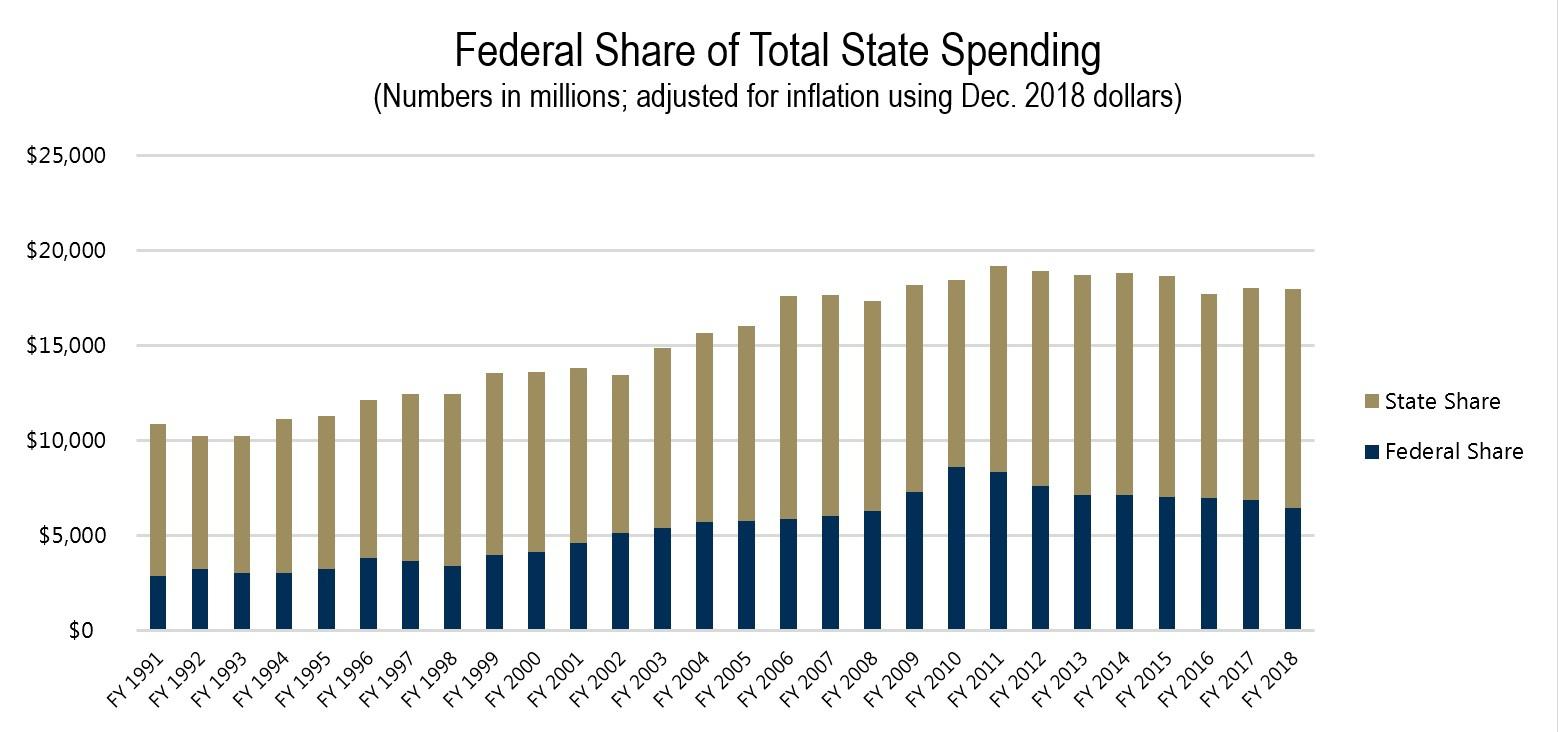

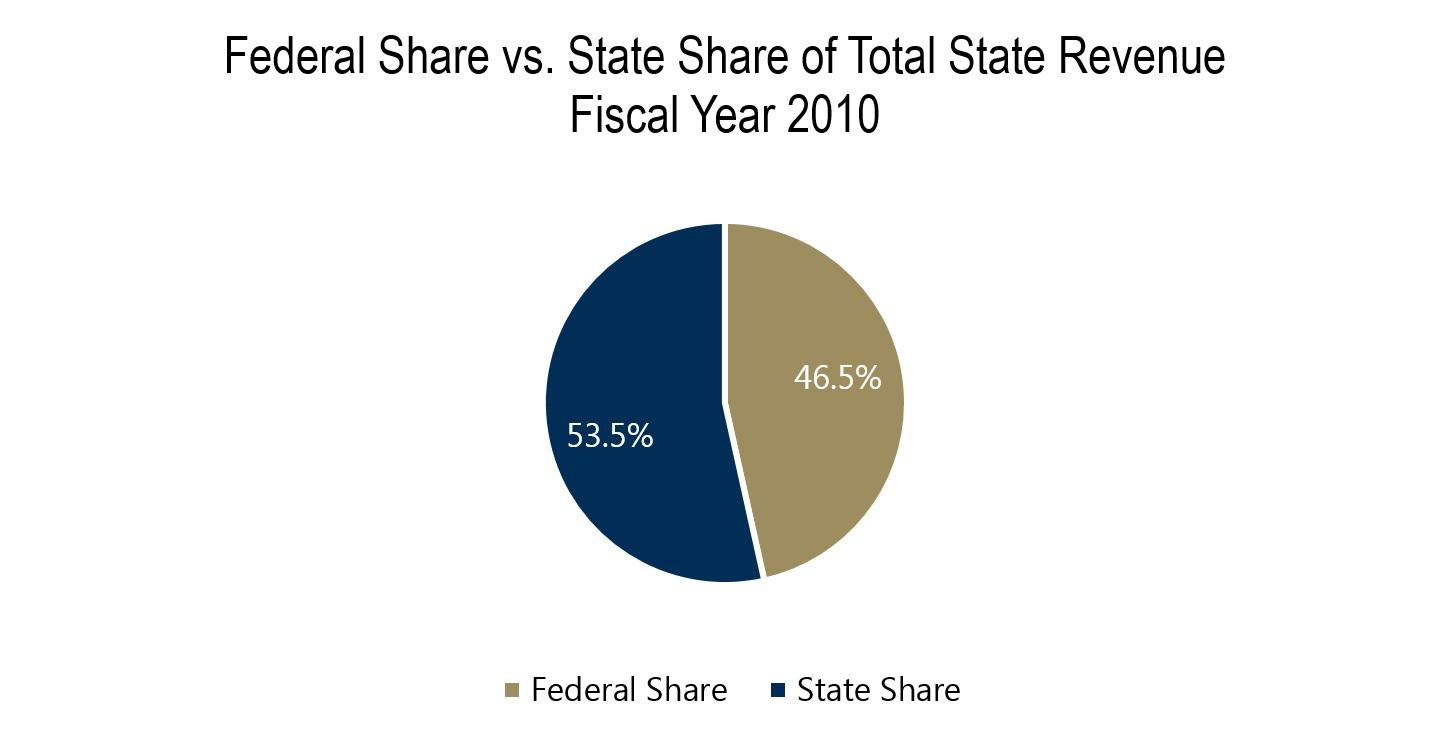

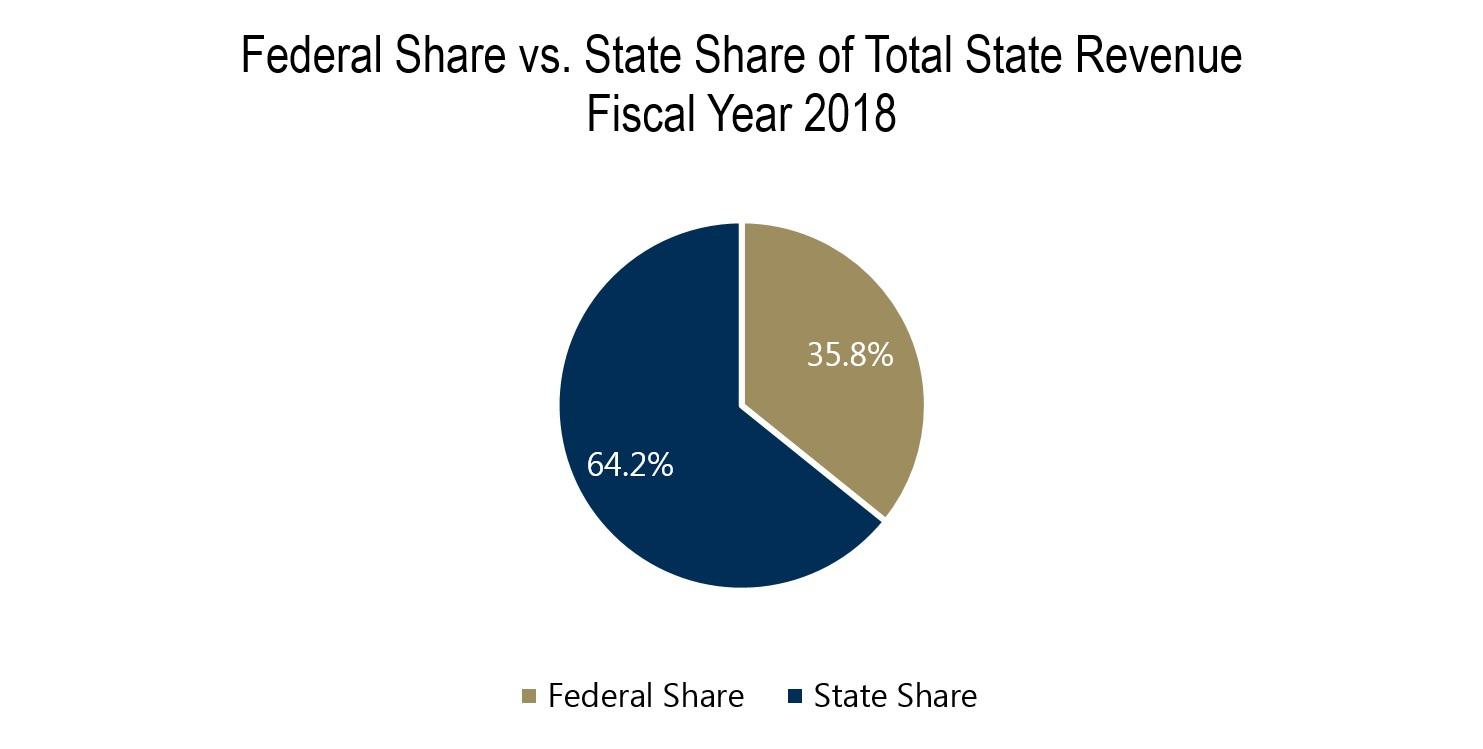

Federal

Share of State Revenue:

Federal grants are the second largest source of revenue for the state of Oklahoma. In fiscal year 2018, it accounted for 36 percent of total revenue. As was noted earlier, a dramatic increase in federal funds was the main driver for the spike in revenue in fiscal year 2011. As Oklahoma was dealing with the financial strain from the nationwide recession, federal dollars flooded into the state. From fiscal year 2008 to fiscal year 2010, revenue from federal grants grew by $2.3 billion while total state revenue only grew by $1.1 billion. This was the peak of federal money at $8.6 billion. This amounted to 47 percent of total state revenue for fiscal year 2010. Since that time, revenue from the federal government has fallen each year and now sits at $6.4 billion—$2.1 billion less than the peak in fiscal year 2010.

Sources:

- Oklahoma’s Comprehensive Annual Financial Report (CAFR), fiscal years 1991-2018

- CPI’s inflation calculator

Curtis Shelton

Policy Research Fellow

Curtis Shelton currently serves as a policy research fellow for OCPA with a focus on fiscal policy. Curtis graduated Oklahoma State University in 2016 with a Bachelors of Arts in Finance. Previously, he served as a summer intern at OCPA and spent time as a staff accountant for Sutherland Global Services.