Budget & Tax

Oklahoma House passes tax cut; ball now in Senate’s court

Ray Carter | January 31, 2024

Members of the Oklahoma House of Representatives have voted overwhelmingly to reduce Oklahoma’s top personal income tax rate to 4.5 percent, immediately, and have sent the measure to the Oklahoma Senate.

However, Senate leadership has indicated that chamber will not take up the bill.

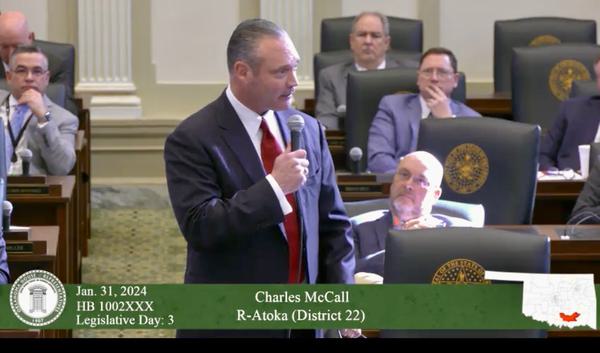

During floor debate, House Speaker Charles McCall called out Senate lawmakers’ inaction.

“We are here again on this issue because the other legislative branch, the other legislative chamber that makes up this state’s Legislature, has refused to take up this issue and make a simple vote on it,” said McCall, R-Atoka. “And I am here to tell you until that day happens, this issue is not disposed of. This issue does not have closure. And you can anticipate and expect that there will be some bills in regular session that we start next week probably on this.”

McCall indicated that other, larger tax cuts may be considered in the regular session. He noted that inflation is hammering families even as state government is in the best financial shape in history.

“It is time to help the people of the state of Oklahoma,” McCall said. “They do a better job of spending their money than we do.”

House Bill 1002XXX, by McCall, would cut Oklahoma’s top personal income tax rate from 4.75 percent to 4.5 percent.

As written, the bill would take effect retroactively on Jan. 1, 2023, meaning the benefit would immediately accrue to Oklahomans filing their 2023 returns by April 15 of this year.

A fiscal impact statement indicated that the tax cut could ultimately save Oklahomans up to $345 million annually.

Democrats opposed the measure, saying most Oklahomans feel little financial impact from paying income taxes.

State Rep. Andy Fugate, D-Oklahoma City, noted that about half of Oklahomans have income below $62,000 and half have income above that level.

“This is a dollar-an-hour pay raise for millionaires in Oklahoma,” Fugate said.

House Democratic Leader Cyndi Munson of Oklahoma City said the tax cut would provide an additional $118 to individuals earning the same $47,000 paid annually to legislators and dismissed that benefit as inconsequential.

But supporters noted struggling families, hammered by inflation under the Biden administration, are not so dismissive of those extra dollars.

“There are people struggling to pay their utility bills,” McCall said. “There are people struggling to afford the basic necessities, and the least amount of relief that we can give, they can use it.”

“It takes more to live today, to buy everyday goods—groceries, fuel—and so it is definitely time to cut taxes,” said House Appropriations and Budget Chairman Kevin Wallace, R-Wellston.

State Rep. Mickey Dollens, D-Oklahoma City, and state Rep. Regina Goodwin, D-Tulsa, both argued that lawmakers should instead raise the minimum wage rather than cut the income tax, with Dollens claiming that only “rich Oklahomans” benefit from income-tax cuts.

“We should not dole out more handouts to the rich,” Dollens said.

Goodwin argued that people who benefit from an increase in the minimum wage would then pay more in taxes to the state if tax rates were left unchanged.

Contrary to Democrats’ claims, Oklahoma’s top personal income tax is imposed on people from all walks of life. The top rate is imposed on those with incomes of $7,200 for single filers and $12,200 for joint filers—or, put another way, people living in poverty.

Also, even many entry-level jobs today pay above the minimum wage.

According to the U.S. Bureau of Labor Statistics, of roughly 935,000 Oklahoma workers paid hourly wages in 2022, just one-tenth of 1 percent were paid minimum wage.

Nationwide, the U.S. Bureau of Labor Statistics reports that 45 percent of workers paid the minimum wage are age 25 or younger, meaning many earning that wage are in college or high school.

Dollens and Goodwin also suggested prior income-tax cuts were the cause of budget shortfalls starting in 2016.

“The folks in this room want to repeat the same mistakes that got us in the bad shape we were in,” Goodwin said.

However, the budget shortfalls of that period were tied to an oil bust that wreaked havoc with the state economy.

“State tax collections are growing at twice the rate that our economy is.” —State Rep. Mark Lepak (R-Claremore)

Oklahoma Tax Commission reports show that Oklahomans lost more than $13 billion in taxable income from 2014 to 2015 and families reduced purchases subject to state sales and use tax by $4.1 billion from state budget year 2015 to 2016. From September 2015 to September 2016, roughly 21,800 oil and gas and manufacturing jobs were eliminated in Oklahoma.

No income-tax rate known to man is capable of avoiding a decline in collections under those economic circumstances.

One Democratic lawmaker even debated against cutting Oklahomans’ income taxes while tacitly admitting she personally may soon be exempted from paying any state income tax.

The U.S. Supreme Court’s 2020 McGirt v. Oklahoma ruling declared that the Muscogee (Creek) Nation’s Oklahoma reservation was never formally disestablished for purposes of federal major-crimes law, and lower courts have expanded the ruling to include the historic reservations of the Choctaw, Chickasaw, Cherokee, Seminole, and Quapaw, a combined area comprising 42 percent of the state.

Several tribal governments are now arguing in court that tribal members living in those areas are now exempt from paying Oklahoma state income tax.

State Rep. Amanda Swope, D-Tulsa, noted she is among those who may not have to pay any state income tax, admitting she “works at a tribal nation.” Swope is a citizen of the Muscogee Nation and lives in the Tulsa area, which lies within the Muscogee Nation’s McGirt “reservation.”

Swope dismissed Gov. Kevin Stitt’s concerns about having a system in which one group of Oklahomans pays income tax while another group of Oklahomans doesn’t based on having ancestors listed on a historic government census of tribal members.

Supporters of tax cuts also noted that state government spending has grown at an unsustainable trajectory, and also stressed that tax collections and government reserves are more than accounting entries.

“What do we really have? Five billion dollars in savings?” said state Rep. John Pfeiffer, R-Orlando. “No. What we really have is … 174,616,109 hours of our citizens’ time, effort, work, sitting in an account, just shy of 20,000 years of toil.”

He noted 26 other states have cut taxes in the last three years.

State Rep. Mark Lepak, R-Claremore, noted that over the last 20 years all Oklahoma government tax collections have increased 3.94 percent year-over-year even as the personal income tax rate was reduced from 7 percent to the current rate of 4.75 percent.

During that same period, Oklahoma’s gross domestic product grew just 1.96 percent year over year, adjusted for inflation.

“State tax collections are growing at twice the rate that our economy is,” Lepak said.

Similarly, Oklahomans’ personal income has increased just 1.45 percent year over year in the past two decades.

“What does it tell you when overall tax collections are growing at twice the economy’s growth, two-and-a-half times that of our personal income?” Lepak said. “It tells me that we are setting a spending expectation that we won’t be able to sustain long term.”

“The fact that our individual income revenue, tax on revenue, is growing greater than the inflation rate over the period of the last nine years also says that we’re not in balance,” Wallace said.

Democrats also touted the opposition of Senate Republican leadership in their debates against HB 1002XXX.

“Here we are, yet again, in another special session, one week before regular session, debating a 0.25 percent income (tax) cut that has zero percent chance of advancing through the Senate,” Dollens said. “The Senate Pro Tem said that this meeting here today is nothing but political theater and a waste of taxpayer dollars.”

But House leaders said Democrats’ embrace of Senate Republican talking points cast a poor light not on tax cuts, but the stance of Senate leaders.

“We’ve heard, now, from both sides of the rotunda,” said state Rep. Jon Echols, R-Oklahoma City. “We’ve heard from our colleagues over in the Senate, and we’ve heard echoed here today, almost identical arguments against us coming in to give the taxpayers’ relief.”

HB 1002XXX passed the Oklahoma House of Representatives on a 71-20 vote. All those voting in favor of the bill were Republicans. All opponents were Democrats.

The bill now awaits a vote in the Oklahoma Senate.

Ray Carter

Director, Center for Independent Journalism

Ray Carter is the director of OCPA’s Center for Independent Journalism. He has two decades of experience in journalism and communications. He previously served as senior Capitol reporter for The Journal Record, media director for the Oklahoma House of Representatives, and chief editorial writer at The Oklahoman. As a reporter for The Journal Record, Carter received 12 Carl Rogan Awards in four years—including awards for investigative reporting, general news reporting, feature writing, spot news reporting, business reporting, and sports reporting. While at The Oklahoman, he was the recipient of several awards, including first place in the editorial writing category of the Associated Press/Oklahoma News Executives Carl Rogan Memorial News Excellence Competition for an editorial on the history of racism in the Oklahoma legislature.