Budget & Tax

Ray Carter | April 29, 2025

Oklahoma Senate committee advances new tax-reform plan

Ray Carter

This year’s legislative session has included much focus on addressing the problems created by Oklahoma’s tax on work and investment, the personal income tax.

Gov. Kevin Stitt has called for lowering the top tax rate from 4.75 percent to 4.25 percent and putting the tax on a path to complete repeal over time.

Both chambers of the Legislature have advanced legislation that would gradually eliminate the income tax by cutting a quarter-point off the top rate whenever state revenue increases by at least $300 million.

Now members of the Senate are considering additional legislation that would lower Oklahomans’ tax burden by eliminating several of the six current tax brackets in Oklahoma’s code.

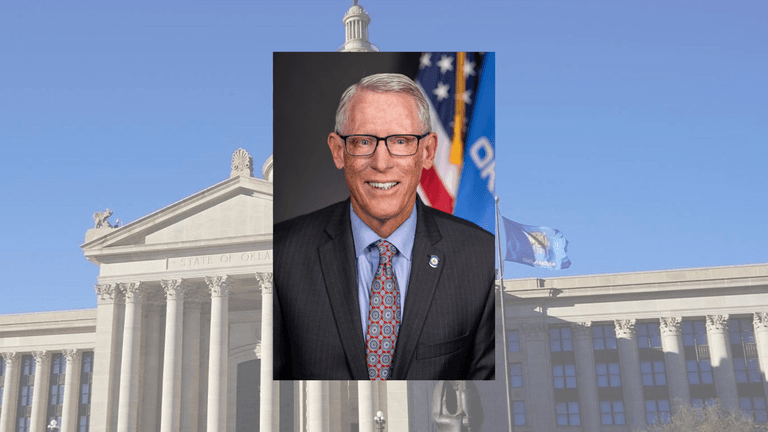

“We were looking at those brackets and we started just asking ourselves, ‘What would happen if we just started eliminating the brackets from the bottom up?’” said Senate President Pro Tempore Lonnie Paxton, R-Tuttle.

Oklahoma’s tax code currently has six income-tax brackets with the first bracket imposing a rate of 0.25 percent on very low levels of income. The tax rate quickly rises to the top rate of 4.75 percent, which is imposed on incomes of $7,200 for single filers and $12,200 for joint filers.

House Bill 1200, by state Rep. Cody Maynard and state Sen. Dave Rader, was amended in the Oklahoma Senate Appropriations Committee to slightly reduce the state’s top income-tax rate and eliminate several lower income tax brackets. Under the bill, there would be only three income-tax rates: 2.75 percent, 3.75 percent, and 4.7 percent.

Rader, R-Tulsa, told committee members the change would eliminate income-tax payments entirely for the lowest-income workers while providing a tax break for Oklahomans of all incomes.

“A family of four filing jointly who makes $24,200 or less per year would see their taxes reduced to zero,” Rader said.

The amended legislation also provides for the gradual repeal of the entire income tax.

Whenever all tax collections increased by $400 million or more, the income-tax rate would be cut by another quarter point. That process would continue over time until the income tax is completely eliminated.

The bill contains a provision saying no income-tax cut would occur if the federal government reduces the federal medical assistance percentage (FMAP) rate for Medicaid expansion below 90 percent for able-bodied adults added to the program through Obamacare expansion, since a change in federal funding would shift more costs to the state and potentially increase state expenses for Medicaid by hundreds of millions of dollars annually.

The amended version of HB 1200 passed out of the Senate Appropriations Committee on a 14-5 vote. The bill now awaits a vote on the floor of the Oklahoma Senate.

Paxton said eliminating lower tax brackets will not only simplify Oklahoma’s tax code but also provide economic benefits to all workers.

“Of the six tax brackets, if you eliminated four of the bottom six brackets, it’s going to cost (state government) around $160 million a year for a fully realized tax cut,” Paxton said, “but it puts about $140 or $150 in everybody’s pocket.”

Ray Carter

Director, Center for Independent Journalism

Ray Carter is the director of OCPA’s Center for Independent Journalism. He has two decades of experience in journalism and communications. He previously served as senior Capitol reporter for The Journal Record, media director for the Oklahoma House of Representatives, and chief editorial writer at The Oklahoman. As a reporter for The Journal Record, Carter received 12 Carl Rogan Awards in four years—including awards for investigative reporting, general news reporting, feature writing, spot news reporting, business reporting, and sports reporting. While at The Oklahoman, he was the recipient of several awards, including first place in the editorial writing category of the Associated Press/Oklahoma News Executives Carl Rogan Memorial News Excellence Competition for an editorial on the history of racism in the Oklahoma legislature.