Education

Texas vs. Oklahoma: Education funding structure

Curtis Shelton | June 6, 2018

OCPA recently highlighted differences in how Texas and Oklahoma pay for public education. These different policies help explain why places like Fort Worth, Texas can offer teachers a starting salary of $52,000.

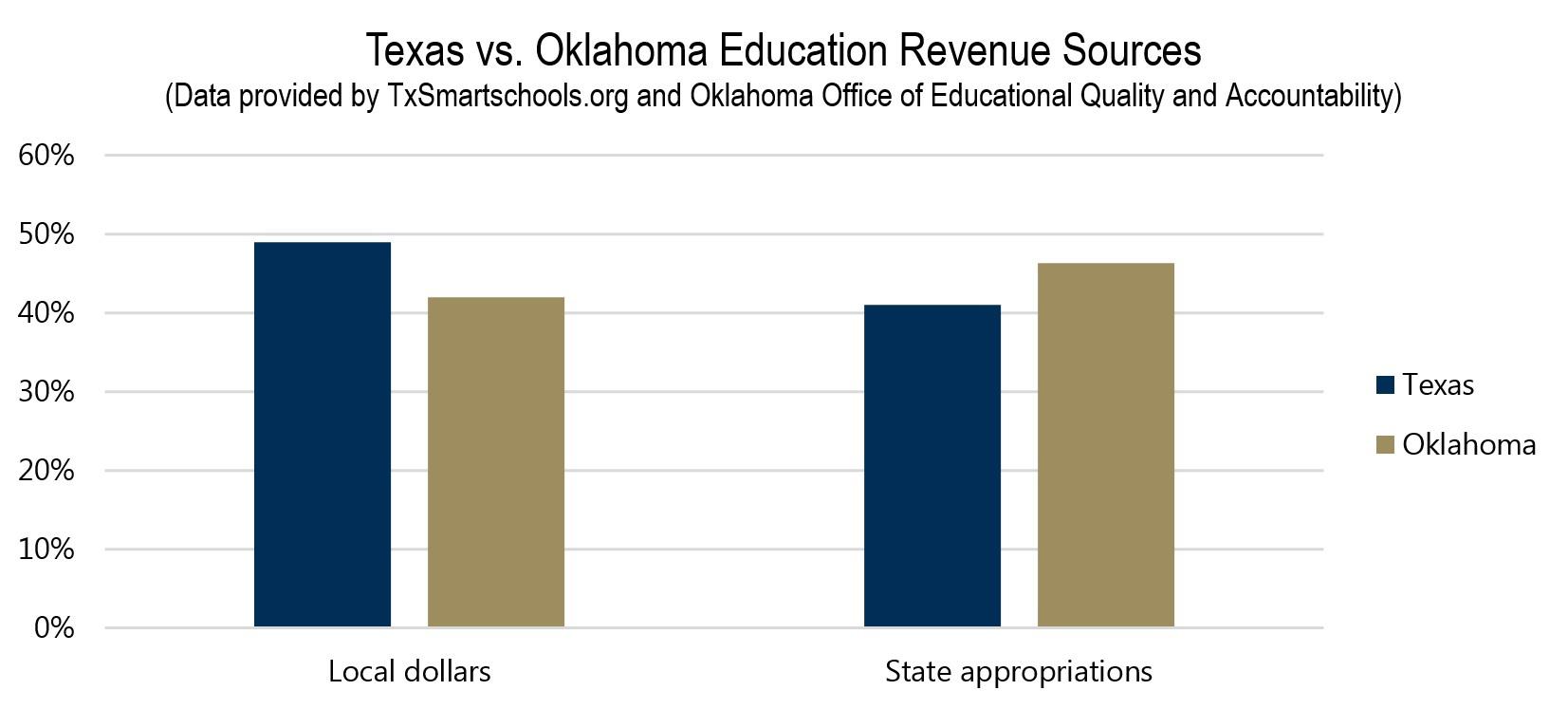

In Texas, 49% of school dollars come from local property taxes, while in Oklahoma that number is 42%. Conversely, Oklahoma school districts get 46.3% of funds from state appropriations, while Texas districts get 41% of their funding from the state.

If Oklahoma schools continued to receive the same state and federal funding—but local areas increased their share of support to K-12 public schools (from 42% to 49%) to match the share local areas contribute in Texas—Oklahoma’s public schools would have an additional $824 million.

Texas also devotes 61% of school dollars to instruction; the figure for Oklahoma schools is 53.7%.

If Oklahoma schools spent the same share of expenditures on instruction as Texas schools, that would mean an additional $384.97 million for instruction, which includes teacher salaries and classroom supplies.

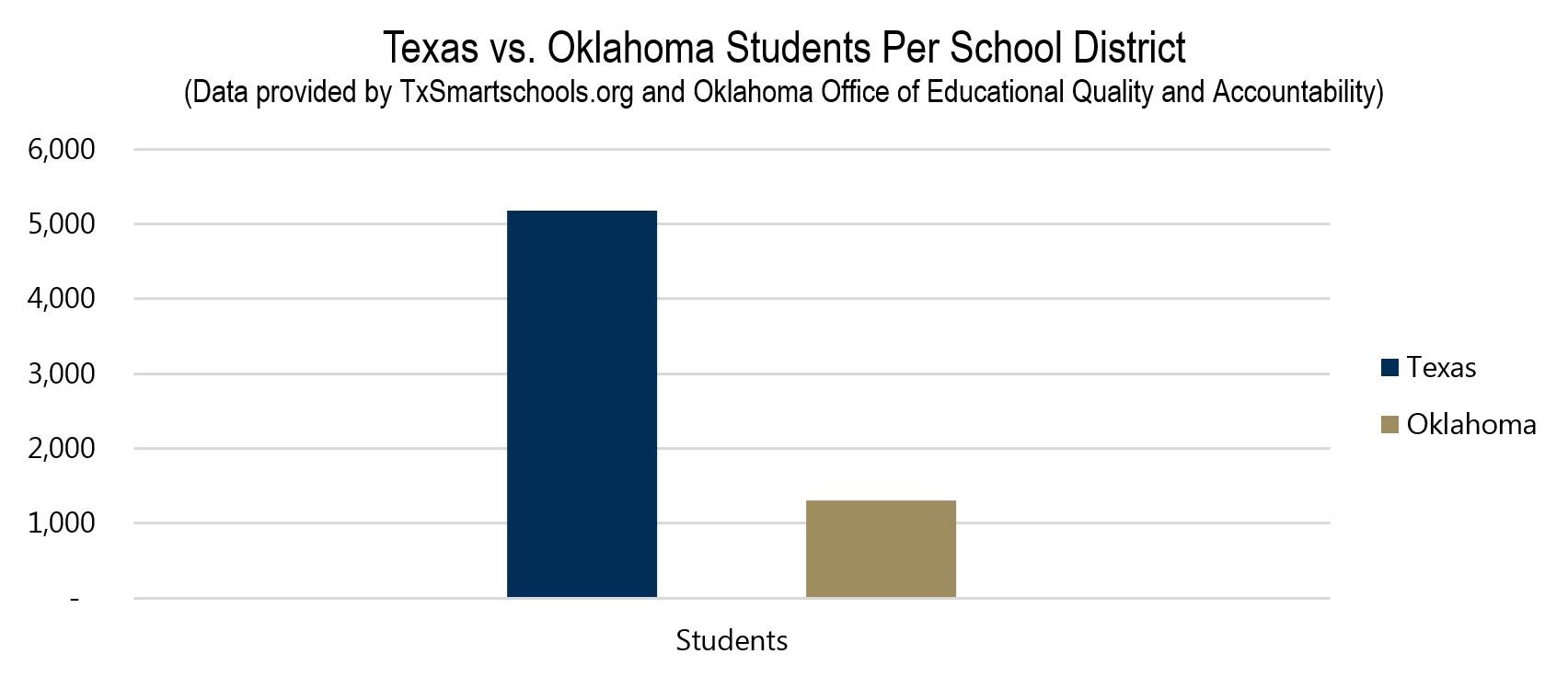

Another difference between Oklahoma and Texas is the number of school districts. Texas has almost twice the number of districts (1,024) as Oklahoma (516), but nearly eight times the number of students. So, while Texas averages approximately 5,175 students per school district, Oklahoma averages roughly 1,300 per school district. Those economies of scale alone allow more school dollars to flow to classrooms south of the Red River.

Curtis Shelton

Policy Research Fellow

Curtis Shelton currently serves as a policy research fellow for OCPA with a focus on fiscal policy. Curtis graduated Oklahoma State University in 2016 with a Bachelors of Arts in Finance. Previously, he served as a summer intern at OCPA and spent time as a staff accountant for Sutherland Global Services.